Philadelphia Semiconductor Index (SOX) represents Semiconductor stocks

Just as the S&P 500 is globally accepted as a proxy for market returns on U.S. stocks. The Philadelphia Semiconductor Index (SOX) is a market index used to represent U.S. semiconductors stock. Welcome to my previous post “A table comparing S&P 500, Nasdaq, Dow Jones, Philadelphia Semiconductor Index over the years since its inception and annualized returns“.

The famous SOXX ETF tracks this index.

Features of this Querier

Querier to Annualized rate of return for Philadelphia Semiconductor Index (SOX) provides two features:

- Enter two sets of years to query the annualized return of the Philadelphia Semiconductor Index (SOX) between any two years

- If the two years entered are the same, you can query the annual return of the Philadelphia Semiconductor Index (SOX) for that year

How to use this querier?

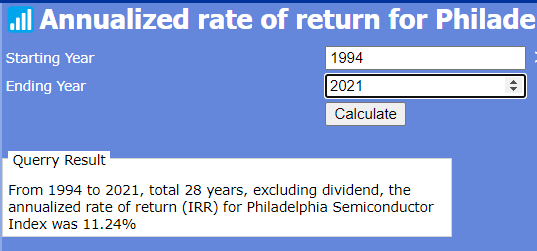

Users simply click on this link to connect to the Querier to Annualized rate of return for Philadelphia Semiconductor Index (SOX) and see the following screen:

User only needs to enter the following two fields on the screen:

- Starting Year: For example, in the example in the screen, we enter 1994

- Ending Year: For example, in the example in the screen, we enter 2021

After the input, click the “Query” button on the screen, and you can see the querry results in the “Query Results” area.

Table for US stock investment toolset

Special reminder

For all major market index annualized return query tools listed in the table; including Taiwan Stock Index, Dow Jones Index, S&P 500 Index, Nasdaq Index, Philadelphia Semiconductor Index, not only annualized return query , you can also query the index return rate in any year──just enter the year you want to query in both the start and end fields.

The following is a list of must-have US stock investment free tools developed by Andy Lin:

For the detail, please see “Free online US stock investment toolset".

Credit: acronymsandslang.com

Related articles

- “S&P 500 index, the only stock worth holding forever“

- “A table comparing S&P 500, Nasdaq, Dow Jones, Philadelphia Semiconductor Index over the years since its inception and annualized returns“

- “Investors should care annualized rate of return (IRR), How to calculate?“

- “Most investors should invest ETFs tracking broader market“

- “US issued ETFs tracking US market is your best bet“

- “Top 10 ETFs and important major US stock market index“

- “Querier to Annualized rate of return for S&P 500 Index“

- “Querier to Annualized rate of return for Taiwan Stock Exchange“

- “TSMC negative corp culture and management style are detrimental to its future and growth“

- “Four chip companies account for one-third of S&P 500 gains so far this year

- “Top five lucrative artificial lucrative intelligence listed companies“

- “What’s TSMC DCF intrinsic value?How to calculate it quickly with a free tool?“

- “How many fabs and houses does TSMC have currently and in the future?“

- “Comparison of TSMC, Samsung, Intel’s Yield and Advanced Process“

- “The TSMC cost, sell price, and R&D cost of chip foundry“

- “ASML, who dominate TSMC’s fate“

- “Comparison of TSMC, Intel, and Samsung’s new process roadmaps for future chips“

- “Two long-term threats to TSMC: US and SMIC“

- “Why is TSMC’s profit margin much greater than competitors?“

- “How does TSMC make money?“

- “Zyvex and sub-nanometer semiconductor processes, will Zyvex threat TSMC?“

- “TSMC gets emerging and serious challenges“

- “How does nVidia make money, Nvidia is changing the gaming rules“

- “The reasons for Nvidia’s monopoly and the challenges it faces“

- “Why nVidia failed to acquire ARM?“

- “Revisiting Nvidia: The Absolute Leader in Artificial Intelligence, Data Center, and Graphics“

- “How does Intel make money? and the benefits to invest in it“

- “Intel’s current difficult dilemma“

- “How does Texas Instruments make money? Amazing long term capital reward and company net profit margin!“

- “How AMD makes money? A rare case of turning defeat into victory“

- “Why is AMD’s performance so jaw-dropping?“

- “Qualcomm diversifies success, no nonger highly dependend on phone“

- “How does the ubiquitous Arm make money?“

- “Significant changes in Broadcom’s business approach“

- “Data center, a rapidly growing semiconductor field“

- “How does Applied Materials, lord of semiconductor equipment, make money?“

- “The lucrative semiconductor supply chain“

- “Global semiconductor chip market in detail, big dominators and markets“

- “6 common wrong semiconductor investment myths“

- “Gen 3 semiconductor“

- “Three EDA oligopoly vendors: Synopsys, Cadence, and Mentor Graphics“

- “How does, the EDA oligopoly, Cadence make money?“

- “How does Synopsis, the EDA oligopoly, make money?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.