Supermicro has absolutely no autonomy in its business. It is a typical manufacturer that relies on others, that is, it can be choked by others at any time──Intel (ticker: INTC), Nvidia and AMD (ticker:AMD) If the three major chip manufacturers find a manufacturer with higher cooperation and lower assembly prices, they may be in trouble at any time.

Category: Stock Valuation

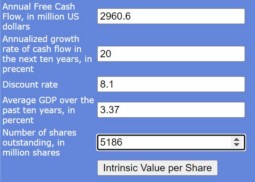

What’s TSMC DCF intrinsic value?How to calculate it quickly with a free tool?

use the discounted cash flow method to estimate, What’s TSMC DCF intrinsic value?

How does the ubiquitous Arm make money?

Without Apple, there would be no Arm

Why Eli Lilly become global pharmaceutical market value king?

It is recommended that you also read my previous post related to Eli Lilly (ticker: LLY): Two future star drugs in hand Because it holds two future star drugs, Eli Lilly is very likely to become the world’s first listed pharmaceutical company with a market value of more than one trillion US dollars! With Alzheimer’s … Continue reading “Why Eli Lilly become global pharmaceutical market value king?”

PayPal’s current crisis and appeal

PayPal in my two books In my book “The Rules of Super Growth Stocks Investing“: In the book “The Rules of 10 Baggers“: How bad is it? The pandemic catalyst is no longer In the two or three years before 2021, PayPal’s stock price, like most technology stocks, has repeatedly hit new highs. Since the … Continue reading “PayPal’s current crisis and appeal”

When to Sell Stocks

When to Sell Stocks Won’t Be Easier Than Buying

Eli Lilly, the world latest largest pharma with astonishing valuation

Eli Lilly can be said to be the pioneer of insulin drugs, and weight loss drugs are its future hope

How can a company increase its intrinsic value per share?

Buffett build Berkshire’s per-share intrinsic value by 5 methods

How did Silicon Valley Bank collapse? What is the impact?

The root cause of the collapse of Silicon Valley Bank and its impact

What is the attraction of current Japanese stock market?

The size of Japanese stock market fell to the fifth in the world, attracting Buffett’s investment