Visa and Mastercard are everywhere

Visa and MasterCard are credit card network providers and do not issue credit cards themselves. Regarding their differences, I suggest you refer to my other blog post “The differences between Visa and Mastercard?“

Why are consumers still using credit cards?

The rise of ecommerce, although more online payment methods have become available, and they have begun to seize the original payment market of some credit card companies, they have not yet significantly weakened the two major credit card companies Visa (ticker: V) and Mastercard (ticker: MA) dominates, because many people still use credit cards to purchase online.

In terms of offline physical stores, the two major credit card companies also face strong competition from the new financial technology industry (Fintech) and technology giants such as Apple Pay (ticker: AAPL), Google Pay (ticker:s: GOOG and GOOGL), Tencent Pay (ticker: TCEHY) and Alipay (BABA). These are indisputable facts. There are many market investigators who are curious about American still holding a credit card. The answer is: I have all the functions that I should use, and I have been using it well. Why should I change it?

Which markets are fintech taking away?

Of course, new financial technology (fintech) players will erode the existing markets of the two major credit card companies, such as BNPL( Buy Now, Pay Later). New entrepreneurs have robbed a lot of the credit card business of the two major credit card companies, because the traditional credit card issuing banks have higher approval thresholds for card debt, which provides fertile ground for the existence and growth of BNPL new entrepreneurs .

But don’t forget that the two major credit card companies will not wait to die. They are also developing new markets and launching new services as the times evolve. it would take a pretty big increase in the size of the buy now, pay later loan originations to make a material impact to credit card originations.

However, roughly 80% of consumers use debit cards to pay off their BNPL transactions. To fight back, Visa has developed point-of-sale and post-purchase options for credit card issuers. The company calls the program Visa Installments Solution.

To be fair, all the businesses of the two major credit card companies (see the next section for details) are strongly challenged by new financial entrepreneurs. Financial new entrepreneurs mainly attacked the high fees of the two major credit card companies, consumers’ desire for faster transfers, and the demand for more diverse services; these are indeed the two major credit card companies currently unable to provide. This is why the market value of financial new entrepreneurs represented by PayPal (ticker: PYPL) and Block (ticker: SQ) can repeatedly set new highs.

The market is visibly eroded

No matter how we discussed earlier, the numbers and trends speak for themselves. As long as you see how much revenue the two major credit card companies lost in the year of the 2020 epidemic (see next section), it will tell you everything. Why do you I said so? Because credit cards are mainly used for face-to-face business transactions, the epidemic has prevented most people from going out at home, and most of their consumption is transferred to online and e-commerce or takeaways.

The problem is that credit card online payment has no advantage. This is why even if the economy keeps growing and the payment transaction pie becomes larger and larger, but the newly developed market will flow into contactless transactions (not all credit cards support contactless transactions) and online transactions are strong and advantageous payment fields for these financial technology players. Even after a year, now in 2021, the revenue of the two credit card companies has only returned to pre-epidemic levels, but it is obvious that they have not grown as much as new financial entrepreneurs. This is a big warning sign.

In addition, BNPL’s credit loan method of enjoying first and paying later is very popular with the new generation of young people, and the application is simple, with almost no threshold restrictions, eliminating a bunch of restrictions on credit card applications and application review and time. This has caused many new payment markets to flow into the pockets of BNPL operators, and many users who use BNPL will pay for larger commodities (because they can’t afford it, this is why they need to apply for BNPL), making the situation worse.

Regarding BNPL (Buy first, pay later), I suggest you refer to the description of my other blog article “The most popular new credit method BNPL“.

Stock performance

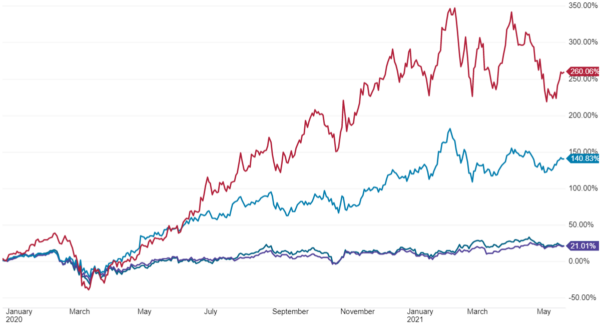

The top red line in the figure below is Block (ticker: SQ), the middle green line is PayPal, and the bottom two lines are Visa and Mastercard. The stock price trend chart from 2020 to the end of May 2021 (from Charles Schwab ).

Main business of credit card issuing network

Let’s take a look at the main businesses of the two major credit card companies:

- Domestic service: that is, the domestic card issuing service, which is the traditional main source of revenue for the two, and is also the service of the credit card company that is more familiar in the eyes of ordinary people.

- Transaction processing: the processing and clearing of payment and financial transactions, which is the so-called background operation service; it relies on the global ubiquitous financial network and huge data processing capabilities of the two major companies.

- Cross-border services: This part is the part with relatively small revenue, but the highest profit (for Mastercard, it has a higher proportion, which is also Mastercard’s strength).

- Other services: This is a new business that the two companies are eager to expand in recent years, including various innovative businesses such as anti-hacking, anti-fraud, anti-money laundering, regulatory compliance, artificial intelligence, biometric payment, and cryptocurrency.

Next, let’s take a look at the revenue and annual growth rate of the main businesses of the two major credit card issuing networks in 2020:

| Card issuing network | Domestic Services | Transaction processing | Cross-border services | Other services |

| Visa | US$ 9.804 billion +1% Y/Y | US$ 10.975 billion +6% Y/Y | US$ 6.299 billion -19% Y/Y | US$ 1.432 billion +9% Y/Y |

| Mastercard | US$ 6.656 billion -2% Y/Y | US$ 8.731 billion +3% Y/Y | US$ 3.512 -37% Y/Y | US$ 4.717 billion +14% Y/Y |

From above table, we can see that the two major credit card companies suffered severe business damage in 2020 due to the global COVID-19 pandemic. In particular, few people go abroad, causing significant damage to cross-border service revenue (domestic services are also inevitable, mainly due to the lockdown and the inability to go out, causing the transaction of physical merchants to shrink, but this part only stops growing) , Mastercard is especially obvious.

These are directly reflected in the stock prices of the two credit card companies in the past year; the past year has been the worst year for the share prices of the two credit card companies since they went public. The company will benefit from the vaccination and reopening after the pandemic, and the stock price has rebounded significantly since 2021.

In the figure below, the purple line is the Visa company stock price trending, and the green line is Mastercard from 2020 to the end of May 2021.

The competitiveness of credit card issuing network

I gave a detailed introduction to these two credit card issuers in sections 2-3 of my book “The Rules of Super Growth Stocks Investing”, and both of them do have a strong moat. This is why these two companies can have the highest gross profit, operating interest rate, and net profit margin of all listed companies (this is the envy of all listed companies).

Many small payment providers, traditional financial companies, and financial technology companies still have to rely on the two major credit card companies as their backends, that is, to handle cash flow services such as clearing and settle. Visa once announced that it has the ability to process 24,000 transactions from all over the world at the same time per second. In contrast, Bitcoin, which has become popular in recent years, can only process 7 transactions per second. Using this example to illustrate, everyone can know the capabilities of the two major credit card issuing network.

No matter what kind of innovative services the new fintech companies provide, or how cashless they are; everyone has forgotten one thing, people still have to withdraw the money after all. The answer couldn’t be clearer. All users of fintech industry will ask the industry to provide an ATM card (called Debit card in the United States). The two major credit card issuing networks are the main ATM card suppliers, and they can withdraw local cash across banks around the world. So how do you say that fintech companies are going to get rid of the two major credit card companies?

One day, a bunch of people lined up in a hypermarket waiting for the checkout, but there was no movement at the checkout counter. Everyone stood there impatiently sliding their phones. It turned out that the network of the credit card machine was down, but the network of my mobile phone is clearly connected! The two major credit card issuing networks have their own networks, cash flow, and clearing systems, which are different from the Internet used by you and me.

This is one of the main resources for the two to compete with other traditional financial industry or new fintech (with their own network, cash flow, and clearing system; you think of them as when you send money abroad, the SWIFT system used by bankers will understand what I mean). Competitors want to build their own, such a dense network system all over the world, and also have to be unanimously accepted by all multinational merchants (you should have never heard of merchants that do not accept the credit card from these two companies); because the barriers to entry are just too high.

Related articles

- “Several possible threats to the Visa and Mastercard credit card networks“

- “What’s the credit card difference among American Express, Visa and MasterCard ? at least 8 differences“

- “American Express, one of the best investments of Buffett’s career“

- “The differences between Visa and Mastercard?“

- “Has the moat of ubiquitous credit card networks loosened?“

- “Amazon’s dominance from stock price trends of PayPal, Affirm, Fair Isaac, Visa, and Mastercard“

- “Union Pacific, representative of the duopoly“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.