More and more people from various countries directly invest in US stocks, which brings about many monetary, financial and geopolitical risks that are not considered when investing in Taiwan stocks. They are worried about whether US stocks are suitable for long-term investment. But in fact, these concerns are unfounded and unnecessary.

The only stock market operating 100+ years

I have emphasized the importance of “sustainability” to stock market investors in my book “The Rules of Super Growth Stocks Investing“: This includes whether the stock market can continue to operate, whether the company can remain listed, Whether the company’s revenue and profit can continue to grow. The only stock market in the world that has operated continuously for more than a hundred years is the U.S. stock market.

The stock markets of Western countries have been interrupted for many years due to the two world wars, and the stock markets of other countries have also been interrupted due to civil strife or political turmoil. only to recover. And only in the US stock market, investors can find many companies that have been listed for more than 100 years.

Safety is the highest guiding principle of investment. Only by investing in US stocks can you keep the stocks you hold for a long time without changing your wallpaper.

U.S. remains leader in most industries

Although China’s total GDP will surpass that of the United States as soon as 2030, the per capita GDP will still be less than half of that of the United States, which will affect consumption levels and capabilities. Moreover, the United States is still the leader in most industries, which is the main reason why the United States can impose an embargo on China’s capabilities in a few high-tech fields such as artificial intelligence, semiconductors, and biotechnology.

The businesses of the constituent companies of the S&P 500 Index have already globalized. Almost every one of them has a huge business in China, and their income comes from all over the world. The larger the scale, the more so.

The stock markets of all countries in the world have one thing in common: investors are willing to pay a higher premium for promising and better-growing companies, and the valuations of technology-leading companies will be much higher. The United States is still the leader of most technologies in the world.

Not only American companies, but also companies with high growth and prospects around the world will also use the US stock market as the first choice for listing, because the valuation is much higher than other stock markets. It means that investing in US stocks is more profitable than other stock markets.

U.S. stocks outperformed relatively

Although the GDP and economic growth rate of developing countries are much higher than those of developed countries, they are not necessarily reflected in the stock market. One of the most famous cases is that China’s stock market returns are completely disproportionate to its amazing economic growth rate over the past 40 years.

As Table 1 shows, not all stock markets in developing countries necessarily outperform developed countries. Of course, the stock market performance of many developing countries is still outstanding, but the stock market information of developing countries is relatively opaque, regulations are incomplete, foreign exchange control, and political risk are still much higher than those of developed countries.

| Country | Country’s large-cap index | Country’s average GDP growth (2013-2021) | Stock market returns in past 10 years | Stock market returns in past 20 years | Stock market returns in past 30 years |

| U.S. | S&P 500 index | 2.027% | 125.35% | 298.40% | 893.56% |

| China | Shanghai Composite Index | 6.556% | 57.15% | 123.93% | 355.73% |

| Japan | Nikkei Index | 0.473% | 117.92% | 185.37% | 61.05% |

| Hong Kong | Seng Index | 1.701% | -20.26% | 51.45% | 119.14% |

| India | Bombay Sensitive 30 Index | 5.622% | 156.81% | 1221.29% | 1486.42% |

| U.K. | FTSE 100 Index | 1.488% | 8.00% | 65.91% | 134.01% |

| Germany | DAX index | 1.122% | 59.99% | 299.84% | 666.27% |

| France | CAC 40 index | 1.026% | 64.24% | 95.19% | 272.79% |

| South Korea | Korea Composite Index | 3.057% | 26.00% | 237.24% | 32.51% |

| Taiwan | Taiwan Weighted Index | 3.293% | 75.48% | 188.23% | 146.73% |

| Singapore | Straits Times Index | 3.131% | -6.41% | 52.43% | 40.62% |

| Brazil | Brazil Index | 0.156% | 107.81% | 190.06% | 599.81% |

| Indonesia | Jakarta Composite Index | 4.151% | 33.96% | 784.34% | 1388.51% |

| Vietnam | Ho Chi Minh Stock Market Index | 5.829% | 94.22% | 366.47% | 1031.48% |

Table 1 – The performance of the world’s major stock markets in the past 30 years (backed by 7/9/2023, the stock market data comes from Google Finance and Yahoo Finance, and the stock market data of some developing countries that have not reached 30 years are expressed in 30 years; the GDP data comes from IMF)

According to Morningstar’s statistical data from 1973 to 2022, compared with the performance of the US stock market represented by the S&P 500 Index and the international stock market represented by the MSCI EAFE Index, the probability that the US stock market outperforms other countries’ stock markets is 59%. In the 10-year period from 2013 to 2022, there will be 8 years in which the performance of US stocks will beat international stock markets.

Should I care exchange rate risk?

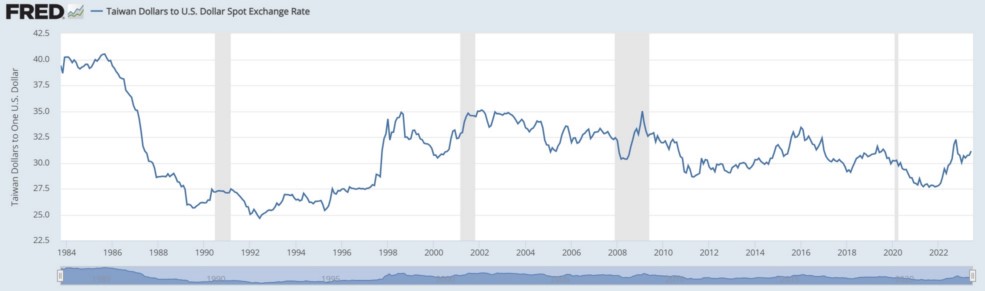

According to the second and third columns of Table 2 (compiled by the author), the exchange rate of the US dollar against the New Taiwan dollar reached a historical high of 40.501 in August 1985 and reached a historical low of 24.770 in June 1992 during the past 41 years. Compared with the S&P 500 index, which represents the trend of the US stock market, it was 531.18 in August 1985 and 885.26 in June 1992 (data from macrotrends.net).

If the investor buys at the highest point of the exchange rate and sells at the lowest point of the exchange rate; although the exchange loss is 38.84%, your stock investment return is positive 66.66%, so the 8-year net investment return during the period is still positive 27.82%.

| Date | US Dollar to New Taiwan Dollar Exchange Rate | Exchange Rate Return | S&P 500 Index | US Stock Return |

| August 1985 | 40.501 | 0 | 531.18 | 0 |

| June 1992 | 24.7695 | -38.84% | 885.26 | 66.66% |

| October 1983 | 39.42 | 0 | 492.45 | 0 |

| June 2023 | 30.8405 | -21.76% | 4,221.02 | 757.15% |

Table 2- USD to TWD exchange rate vs US stock returns (1983-2023)

According to the fourth and fifth columns of Table 2, the exchange rate between the US dollar and the New Taiwan dollar in the past 41 years is 38.42 in October 1983 and 30.8405 in June 2023. Compared with the S&P 500 index, which represents the trend of the US stock market, it was 492.45 in October 1983 and 4221.02 in June 2023. If an investor invests in U.S. stocks at the beginning of the period and then sells them at the end of the period; although the exchange loss is 21.76%, your return on stock investment is a positive 757.15%, so the net investment return during the 41-year period is still a positive 735.39%.

It can be seen that long-term investors do not need to care about exchange rate risk when investing in U.S. stocks, and the two extreme examples analyzed above all prove that even if investors have exchange losses, they can still get a considerable return if they are offset by the return on investment in the stock market.

Figure 1- US dollar to New Taiwan dollar exchange rate (1983-2023)

De-dollarization is unlikely to come true

The most influential currency now is the US dollar. Compared with other currencies, the exchange rate of the US dollar is considered stable. As shown in Figure 1, during the past 41 years, the fluctuation of the US dollar against the New Taiwan dollar was very stable compared with other currencies with floating exchange rates in the world. It is also impossible for the U.S. dollar exchange rate to fluctuate greatly, because the impact is too great.

According to statistics from the Bank for International Settlements, the US dollar accounted for more than 70% of global official foreign exchange reserves in 2000, and about 60% in 2020. The research published by the British think tank OMFIF or JP Morgan Chase in June 2023 both pointed out that this figure is 58%.

According to data released by JPMorgan in June 2023, the U.S. dollar accounts for 88% of the global trading volume of currencies.

In recent years, the US dollar’s share of global cross-border remittances has indeed declined slightly due to the competition between the renminbi and the euro, but it still accounts for more than two-thirds of the overwhelming proportion. The overall national strength of the United States is still unique. For those who are alive now, the United States will still dominate the world in their lifetime. Investing in U.S. stocks is still the most profitable and reliable way to accumulate assets.

Closing words

The factors that many investors worry about listed in this article will not cause too much harm to the long-term investment value of US stocks.

I am the author of the original text, and the condensed version of this article was originally published in Smart magazine.

Relative articles

- “Global stock markets performance comparision over the past 30 years in a table“

- “Why are only US stocks the most valuable for long-term investment?“

- “India stock tripled in three years to US$3.56 trillion, ranking fourth in the world“

- “Booming India stock market and the emerging Indian tech giants“

- “Indians do well in the US, India’s weak and uncompetitive industries“

- “Japan is already a country of mediocrity, not as advanced as you think“

- “South Korea’s emerging technology giant“

- “Israel stock market and tech giants“

- “Will Sino-US confrontation, de-globalization, and de-dollarization affect the long-term investment value of US stocks?“

- “The relationship between GDP and stock prices“

- “US Gross domestic product (GDP) querier“

- “The hardware and software gap between China and US, is all China-made software and hardware possible?“

- “S&P 500 index, the only stock worth holding forever“

- “Querier to Annualized rate of return for S&P 500 Index“

- “How investors should look at economic trends and forecasts?“

- “Should investors care about currency exchange risk when investing in US stocks?“

- “Tax, inflation and rate are the top three serious killers to investors“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.