Introduction

Background

Satya Nadella was born in Hyderabad, India. After completing college in India, he obtained two master’s degrees in computer science and business management in the United States.

Career

He worked at Sun Microsystems, joined Microsoft in 1992, and eventually became the head of Microsoft’s enterprise and cloud computing department. He served as vice president of Microsoft’s online research and development department and Microsoft’s commercial department. Before taking over as CEO, the Azure enterprise business he led had already shown signs of success. This is why Microsoft chose him to become its third CEO. The most important reason.

The third CEO of Microsoft

Satya Nadella is the third CEO of Microsoft. He took over the job from the underperforming Steve Ballmer in 2014. His performance so far can only be described as impressive. To describe with admiration. Due to his highly recognized performance, Nadella also served as chairman of Microsoft on June 16, 2021.

The Most Underrated CEO

From 2017 to 2022, Nadella has been named “The Most Underrated CEO” by Fortune magazine for six consecutive years.

Nadella saved Microsoft from fire and water twice and brought Microsoft back to the top. First, through the successful transformation of its cloud computing business, it became the world’s second largest listed company by market value after Apple. In the era of artificial intelligence, his foresight has been verified again.

According to Wall Street Journal, Microsoft Tops the List of Best-Managed Companies of 2023, with Apple, Nvidia, Alphabet and IBM rounding out the top 5.

Leaders in three major trends in technology

Important tips

Nadella has fully integrated the following three most important changes in the technology industry in the past ten years into Microsoft’s major products. Please note that Microsoft is not a small company. The company’s product lines are numerous and the complexity is unimaginable, but he can do it It arrived, and it was extremely successful. How to prove it? The answer is that it is already reflected in the company’s revenue.

Microsoft’s product line is very long, and it also has a lot of historical baggage; but Nadella can actually “horizontally” integrate the following three most important trends in the technology industry throughout all Microsoft product lines! As the main axis of all Microsoft products, I really admire this.

Cloud computing

At present, Microsoft’s global IaaS market share in cloud computing is very close to Amazon’s long-term dominance. However, if PaaS and SaaS are included, Microsoft has long been the number one global market share in cloud computing. For an in-depth explanation of this part, please see my other blog article: “Microsoft, the dominant overlord of cloud computing“.

Artificial Intelligence

Under the leadership of Nadella, Microsoft has made the following important layouts:

With a clear goal

Microsoft CEO Satya Nadella made it clear that Microsoft aspires to become an important force in the AI ecosystem. From developing its own artificial intelligence acceleration chip to launching the Copilot market, Microsoft has formulated a long-term strategy for artificial intelligence. It is leveraging its platform monopoly position to innovate in hardware and software to maintain its dominance in the industry.

OpenAI’s largest shareholder

In 2019, it cooperated with OpenAI, the developer of ChatGPT, which will occupy all technology and financial pages throughout 2023, and successively invested billions of dollars to acquire 49% of the company’s shares; occupying the position of generative artificial intelligence strategy High Point.

Bing Search engine enhancement

Few people know that Bing is one of the very few large Western search engines available in China. It has made major improvements to Microsoft’s search engine, Bing, and continues to take the initiative, trying to seize the market and customers from Alphabet.

Even before Alphabet’s Chrome, ChatGPT was integrated into the Bing browser, giving Bing the ability to generate conversational artificial intelligence. In March 2023, Bing’s monthly active users exceeded 100 million, 1/3 of which were new users, and the number of visitors increased by 15.8% compared with the previous quarter.

Extensive refurbishment of products

Integrate generative artificial intelligence into all Microsoft products. Microsoft’s product line is very complex, the complexity is unimaginable, and the project is huge. However, under Nadella’s leadership, results were immediately announced within half a year and the Copilot artificial intelligence assistant was released. Not only does it integrate Copilot into Windows, it also gives Microsoft’s main revenue sources, such as the Office family, Teams, Dynamic, and Power, new capabilities in generative artificial intelligence. And let Microsoft cloud computing Azure provide various cloud solutions for a new generation of generative artificial intelligence.

Artificial intelligence model

Microsoft is developing its own artificial intelligence “little model.” Compared with traditional large language models, Microsoft Phi-1.5 and Phi-2 are lightweight small language models that require fewer resources. Phi-1.5 has 1.3 billion parameters and Phi-2 has 2.7 billion parameters, which is much smaller than Llama 2 (which starts with 7 billion parameters and can reach up to 70 billion parameters).

These small models are ideal for embedding in Windows to provide a native Copilot experience without the need for round-trips to the cloud. The key point is that it can be executed directly on the terminal device without having to connect to a powerful remote cloud server. Microsoft has also released an extension for Visual Studio Code that allows developers to fine-tune these models in the cloud and deploy them locally for offline inference.

Microsoft has also developed the Florence model to allow users to analyze and understand images, videos and languages; Microsoft’s model platform Azure ML now also supports Llama, Code Llama, Mistral 7B, Stable Diffusion, Whisper V3, BLIP, CLIP, Flacon and NVIDIA Other open source basic models, including Nemotron, provide customers with the most comprehensive and extensive selection of basic models.

The only Large software company making money from AI

One of Nadella’s most rare achievements is that Microsoft is the only large software manufacturer that has “started to make money” from artificial intelligence. Comparing Meta and Alphabet, solutions in this area are still suffering huge losses, which further demonstrates Nadella’s outstanding leadership and amazing execution.

Microsoft Finance Chief Amy Hood said in July 2023 that Microsoft’s new artificial intelligence products will become the company’s fastest business to reach 10 billion US dollars.

Subscription

Microsoft has switched all products on the cloud to a subscription system, and product licenses are no longer sold out at a high price at one time. This is not an easy task, but Nadella did it.

The only one that has not switched to a subscription system across the board is the Windows operating system, because the operating system is not as good as on-demand products or applications, and many complex problems still need to be overcome. But Microsoft is actually moving in this direction, and is testing the water temperature through many small tests. In the long run, even the Windows operating system will be changed to a subscription system. This is an unquestionable direction.

Acquisitions and investments

OpenAI

In addition to acquiring 49% of OpenAI’s shares and becoming the largest shareholder, Nadella also took advantage of the internal strife in OpenAI’s leadership. The board of directors suddenly fired CEO Altman, leading to the resignation of President Brockman. In Altman’s last week After Wu was unexpectedly dismissed by the board of directors, almost all OpenAI employees threatened to leave. Microsoft moved quickly to recruit Altman, Brockman, and many key engineers.

In the end, Microsoft was the only big winner in the coup of OpenAI. Not only did the stock price surge for many days, bringing the market value to US$2.8 trillion, but it also allowed the father of ChatGPT to return to OpenAI to take control of the company and lead the reorganization of the future board of directors, Ultraman. , Microsoft all have new boards of directors.

This proves that OpenAI’s board of directors is stupid, and it shows Nadella’s grasp and decision-making of key situations, and his commendable ability; Nadella’s battle has won unanimous high praise from Wall Street, Silicon Valley, and the American business community, which is full of praise. He showed off his “incredible execution skills.”

Become a leader in the gaming industry

“PC-era game dominator Activision Blizzard acquired by Microsoft acquired” allowing Microsoft to consolidate its position as one of the top leaders in the gaming industry.

Cloud gaming platform

The cloud-based gaming and subscription services promoted in recent years have made Microsoft an important player that cannot be ignored in the gaming industry. The Xbox Game Pass subscription service that utilizes the cloud gaming platform launched by Microsoft, coupled with Microsoft’s XBox game device, as well as the large and small game studios that have been silently acquired for decades, and countless games of various types, have made games a widening moat for Microsoft. a major competitiveness.

Minecraft

Before Nadella took office as CEO of Microsoft, he fought against all odds to allow Microsoft to acquire Mojang, the studio behind the Minecraft series. Although Microsoft spent a very high price of US$2.5 billion at the time, the game has now become a money-attracting machine for Microsoft. Recently, Microsoft can earn US$100 million in revenue from the Minecraft game every year. Other data shows that as of October 2023, Minecraft has sold more than 300 million copies. The game is available on almost all platforms. In addition to selling the game itself, Microsoft also sells it through in-game stores, official server rentals, peripherals, etc. achieved considerable income.

Other cases

In June 2016, Microsoft bought LinkedIn for US$26.2 billion and delisted it. This has given Microsoft a voice in social media. After years of hard work, LinkedIn is now the world’s largest job search network in the field of human resources. It has the most complete personal resume database of professional talents in the world and is one of the few in the world. A social networking platform with over one billion monthly active users.

GitHub

In June 2018, Microsoft bought GitHub for $7.5 billion. GitHub is the world’s largest cloud development code storage platform. As of May 2023, it has more than 100 million monthly active users.

Microsoft is currently promoting the use of Git to control the development of the Windows ecosystem to create the world’s largest Git repository.

Other reforms

Hardware

Although Microsoft’s Surface hardware family currently does not bring much profit to the company, the strategic Surface hardware family’s extensive product line has become a force that cannot be ignored in the technology industry. Frankly speaking, Microsoft has achieved its original purpose of establishing this department, becoming Apple in the Windows world, and achieving its original goal of competing with Apple.

Chip development

In the past, CPUs set the rules for software architecture and influenced its development. Now GPUs are also affecting the development of artificial intelligence, and Microsoft wants to directly control this key link. At the 2023 Ignite conference, Microsoft released its first customized Azure Cobalt and AI acceleration chip Azure Maia.

Personal computer chip

Following Apple, Microsoft plans to design its own chips for Surface notebooks, desktops, and servers. This has long been public news known to everyone in the technology industry.

Athena

Reduce machine learning costs. It is specially designed for data center servers that train and execute large language models, reducing dependence on Nvidia and reducing operating costs. The goal of the Athena chip is to replace the expensive A100 and H100 and provide a computing power engine for OpenAI. Athena chips are manufactured by TSMC, using an advanced 5nm process, with a team of nearly 300 people.

Cobalt

Microsoft Azure Cobalt is a cloud-native chip based on Arm architecture optimized for performance, power and cost-effectiveness for general-purpose workloads. Nadella claimed that this CPU chip is already used in parts that support Microsoft Teams Azure communication services and Azure SQL; this product will also be available to customers in 2024.

Maia

Microsoft Azure Maia is an AI acceleration chip that is used to perform cloud training and inference for AI workloads such as OpenAI models, Bing, GitHub Copilot, and ChatGPT. This chip is manufactured using a 5-nanometer process and has 105 billion transistors.

Boost

Microsoft’s own DPU-Azure Boost is also fully available. Microsoft acquired DPU company Fungible earlier this year to improve the efficiency of Azure data centers. With Azure Boost, software functions such as virtualization, network management, storage management and security are offloaded to dedicated hardware, allowing the CPU to spend more cycles on workloads instead of system management. This offloading greatly improves the performance of cloud infrastructure as the heavy lifting is offloaded to dedicated processors

Create another new chapter for Microsoft

Changing the company culture

Under Nadella’s leadership, the “One Microsoft” corporate culture has accelerated and taken root in Microsoft. He believes that employees should focus on cooperation rather than fear of competition: “Our attitude should change from ‘knowing everything’ to ‘learning everything’.

After he became CEO, the phenomenon of management chaos and intrigues gradually increased. Reduced. Employees began to build trust, share new ideas with each other, and truly collaborate. They no longer thought about attacking each other, competition, performance, and bonuses all the time. This unhealthy internal problem that has long plagued Microsoft employees. culture.”

Staying successful is more difficult than starting a business

Gates founded Microsoft, led Microsoft to go public, and led Microsoft in its early years. He played a huge role in this. There is no doubt that he created one of the few listed companies in the US stock market that has increased its stock price by a thousand times. But in terms of business management, starting a business is much more difficult than maintaining a business. The same case also happened to Apple’s Steve Jobs and Cook.

For a similar story at Apple and the performance of Jobs and Cook, please refer to my previous post for a detailed introduction: “Steve Jobs’s Apple innovation gone with him?“.

Share price performance

Was Wall Street’s darning

Microsoft’s stock price performance was very strong in the early days. Before 2000, it often carried out stock splits of multiple shares every one or two years, and the stock price immediately returned to the pre-split level the next year. This was a rare miracle for U.S. listed companies , so far few companies can have the same performance.

Fourteen bleak years

But after the second CEO Ballmer and before Nadella took over, Microsoft’s stock price performance can only be described as disastrous. I have mentioned in both of my books “The Rules of Super Growth Stocks Investing” and “The Rules of 10 Baggers” that during this period, the company’s stock price did not rise even if it did not rise, and it also fell by a quarter, causing dissatisfaction among long-term shareholders and constant doubts on Wall Street.

Microsoft and Intel

I mentioned in my previous post “The rebirth and fall of 4 major technology stocks in 10 years“: Ten years ago, the market value of these two companies was the same. Today, ten years later, a company has ascended to the the world’s second valuable positoin, with its stock price soaring 12 times. Another company has fallen from the global semiconductor throne, repeatedly giving up all the crowns it once held.

After Nadella took over

However, since Nadella took over in 2014, Microsoft’s stock price performance has been completely different. The company’s stock price has increased almost 9 times, occupying the runner-up position in the U.S. stock market for a long time, and briefly surpassed Apple to become the market capitalization king of the U.S. stock market. . In the American corporate world, where capital market performance is one of the main assessment items for CEOs of listed companies, they are among the top gifted students. Especially for listed companies like Microsoft and Apple, whose market capitalization has exceeded 1 trillion, it is actually very difficult for the company’s stock price to continue to rise for many years and break new highs again and again.

Stock performance of three CEOs

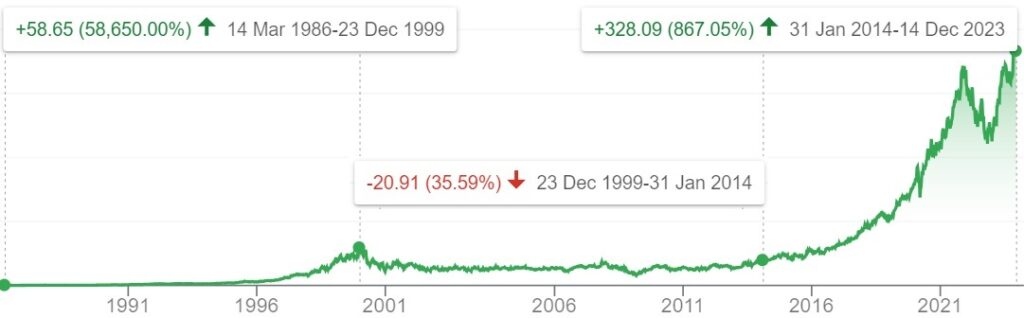

The following is a table of Microsoft’s stock price growth during the reigns of Gates, Ballmer, and Nadella, the three CEOs of Microsoft to this day.

| CEO | Tenure | Duration | Share price performance |

| Gates | March 1986 to January 2000 | 14 years | +58,650% |

| Balmer | January 2000 to February 2014 | 14 years | -35.59% |

| Nadella | February 2014~present | 9.8 years | +867.05% |

The company’s stock price continued to hit record highs during Nadella’s tenure. On November 28, 2023, Microsoft’s stock price hit a record high of $384.3.

The picture below shows the company’s stock price trend during the tenure of Microsoft’s three CEOs (data from Google Finance)

I am the author of the original text, the essence of this article was originally published in Smart Magzine, issue of Jan 2024

Related articles

- “Top five lucrative artificial lucrative intelligence listed companies“

- “Why software underperforming amid the AI craze?“

- “Satya Nadella brings Microsoft back to glory“

- “AI PC is changing the PC supply chain and ecosystem“

- “How does database monopoly Oracle make money? What are the prospects?“

- “Indians do well in the US, India’s weak and uncompetitive industries“

- “Indians are the CEOs of 30% of the Fortune 500 listed companies in the United States“

- “India stock tripled in three years to US$3.56 trillion, ranking fourth in the world“

- “Booming India stock market and the emerging Indian tech giants“

- “How Microsoft makes money? Where is the future?“

- “Microsoft Productivity and Business Processes Office is long term cash cow“

- “PC-era game dominator Activision Blizzard acquired by Microsoft acquired“

- “Microsoft, the dominant overlord of cloud computing“

- “Is Microsoft’s personal computer computing department a tasteless one?“

- “Major artificial intelligence companies in US stocks market“

- “The artificial intelligence bubble in the capital market is forming“

- “Bill Gates’ Investment Empire“

- “Steve Jobs’s Apple innovation gone with him?“

- “The rebirth and fall of 4 major technology stocks in 10 years“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.