In this post, we’ll discuss the rebirth and fall of 4 technology stocks in 10 years.

Two giants Microsoft and Intel

Once on an equal footing for twenty years

Investors in both Taiwan technology stocks and U.S. stocks have been deeply impressed in recent years by seeing Microsoft (ticker: MSFT) and Intel (ticker: INTC), the two giants of software and hardware in the technology industry 20 years ago, have not Rapid rebirth and fall within ten years. These two companies can be said to be synonymous with the world’s technology industry for more than 20 years, leading the development of global technology, especially for Taiwan’s electronic information supply chain (in a broad sense, accounting for 70% of the weight of listed companies in Taiwan).

It is not an exaggeration to say that Taiwan’s electronic foundry industry was originally based on the supply and demand of these two companies. This transformation in less than a decade is a good example of how impressive and vivid the global investment is. In the past ten years, from the same market value, one company has ascended to the global market value throne, and its share price has risen 12 times.

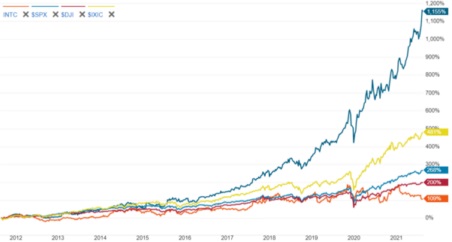

Another company fell from the global semiconductor throne, and has repeatedly surrendered all the crowns it once had. During the rare bull market in the U.S. stock market, the stock price rose only 108%, not only far behind the Nasdaq’s 481% which representing technology industry, but also behind the S&P 500’s 268, which represents the broader market. Moreover, it is even only half of the increase of the Dow Jones, which represents the traditional industry (see Figure 1).

The changes in the market value of these two companies not only speak to the rapidly changing nature of the technology industry, but also prove that there is no permanent enterprises moat, and the result of capitalism’s high competition.

Share price performance of Microsoft and Intel over the past decade

Figure 1: Microsoft (dark green line), Nasdaq (yellow line), S&P 500 (light green line), Dow (red line), Intel (orange line) over the past decade (from Charles Schwab)

As can be seen from the above figure:

- The last five years from the second half of 2017 to today are the main periods that have caused both Microsoft and the Nasdaq to soar (please pay special attention: in 2014, Microsoft replaced the company’s third CEO Nadella, In 2016, Intel ended the mobile computing mobile phone and tablet division, and Lisa Su took over as the CEO of AMD in 2014); while the stock prices of the other three performed in two different segments in the first and last five years, there is almost no difference, they are all just a very slow rise.

- Intel was the worst performer of the five at 108%. Microsoft has 1,155%, the Nasdaq has 481%, the S&P 500 has 268%, and the Dow has 200%. Note that two companies, Microsoft and Intel, are very few of the three major indexes that represent the broader U.S. stock market at the same time.

- Clearly, investors can easily beat non-tech-tracking ETFs (such as SPY and VOO, which track the S&P 500) by investing in tech-focused Nasdaq ETFs (such as QQQ).

What happened in these ten years?

Investors must be curious as to what happened in the past decade to have this result:

Intel in past 10 years

- After losing tens of billions of dollars, Intel announced the end of the mobile computing division in 2016, that is, officially abandoned the mobile phone and tablet business.

- Intel’s 99 percent market share in data center servers, where it has traditionally been a near-monopoly, began to decline. According to Mercury Research’s market survey in the third quarter of 2021, Intel’s market share dropped to a low of 75% in the past ten years due to the PC central processing unit (CPU), and AMD won 24.6%. In the CPU part of X86 servers, AMD has an astonishing 10% market share.

- Intel started at 14nm, and all major chip manufacturing processes have been delayed again and again, and the chip manufacturing technology that was once proud of has passed bit by bit in the past ten years. The technology gap of more than two generations behind Samsung and TSMC has made it impossible to catch up in 5 years even if everything goes smoothly now can be done.

- Intel has had three CEO changes in the last three years. Regardless of the size of the company, for any reason, this represents a fatal business crisis for the company, which shows how serious the internal problems are.

- In the new areas of the technology industry in the past five years, Intel has spent the highest US$15.3 billion in the company’s history to buy Mobileye, an Israeli self-driving company; in other fields such as artificial intelligence, big data, cloud computing, and cryptocurrencies; almost all of them are lagging behind, lackluster, and is not a leader in the industry.

- Under the unyielding leadership of Jensen Huang, Nvidia (ticker: NVDA) returned from a bad feat in the field of mobile computing and regrouped after losing its troops. Taking advantage of its inherent parallel computing advantages in graphics computing processing, and taking advantage of the favorable conditions of artificial intelligence, big data, cloud computing, cryptocurrency, self-driving, and metaverse. It takes advantage of this rare opportunity to seize these major fields. What is even more amazing is that Nvidia has achieved great success in these fields, which is rare in the history of enterprises, and of course this is directly reflected in its stock price performance in recent years.

- AMD (ticker: AMD) gave up its own production of chips, split the production division into Global Foundry (ticker: GFS), and used the advanced process technology of TSMC (ticker: TSM) to produce high-end and the company’s main chips, grabbed considerable PC CPU market previously dominated by Intel. Not only that, AMD recruited Lisa Su from Freescale (acquired by NXP in 2016, ticker: NXPI), to take over as CEO, reorganizing the company’s leadership team. Boldly open the authorization of x86 central processing unit and graphics display processor (GPU) to the outside world in exchange for the company’s much-needed cash, and beat Nvidia to win the graphics card for Apple PC, Microsoft X-Box, Sony (ticker: SONY)’s Play Station, Valve’s Steam Deck console, and more. A series of actions have brought the company back to life. The stock price has risen from the lowest point of US$ 1.66 on September 28, 2015, which is close to the standard of delisting, and has risen to 137.5 at an alarming rate in only 6 years, which is an almost impossible task. Shares rose 148% in 2019, making it the biggest gainer for the year in the S&P 500 and Philadelphia Semiconductor Index, surging 21-fold in ten years. If it is counted from the bottom to the present, it has risen as high as 82 times.

If investors want to simplify the market value growth of Nvidia and AMD in recent years, it is not unreasonable that Intel’s failures come from them. That is to say, in the best case, if Intel is still the giant in the semiconductor industry 20 years ago, and if neither Nvodia nor AMD took advantage of it, Intel’s market value growth should be the sum of the market capitalization increases of Nvidia and AMD over the years, or even higher. Of course, there is no such thing as an “if” in the real world.

Microsoft in past 10 years

What about Microsoft?

- Abandoning the company’s long-standing taboo and declaring that the company no longer has Windows as the center of its products.

- Not only has the software embraced all mainstream operating systems on the market, including Linux, Android, and iOS, but also started to build support for running Android programs in the newly launched Windows 11. On hardware platforms, Windows also began to run on non-x86 CPUs; this greatly expanded Microsoft’s ecosystem. After more than ten years of hard work, they are now beginning to bear fruit.

- In 2014, Satya Nadella became the company’s third CEO, declaring the company’s technology and corporate culture to be fully open.

- Embracing the new technology era dominated by the cloud, in addition to Microsoft’s own software (including Windows, Office, and games), which has begun to adopt the software trend of subscription and SaaS, it has also launched the cloud infrastructure Azure service. Combined with Amazon’s cloud infrastructure AWS services, they account for up to 2/3 of the global market share, forming a substantial oligopoly (according to Gartner’s 2020 Global IaaS Public Cloud Service Market Share Report, Amazon, Microsoft, Alibaba, Alphabet’s market shares are 40.8%, 19.7%, 9.5%, and 6.1%, respectively).

- Launching the Surface hardware product line, aside from making no money, it can be said that Microsoft has achieved great success in company image, voice, customer usage habits, product integration, and market visibility. This is not something that can measure by money.

The market capitalization of the two was equal, and now the difference is 12 times

Ten years ago, in early November 2011, Microsoft’s market capitalization was about $124.7 billion, and Intel was about $127 billion; the two were almost on par. However, as of November 4, 2021, Microsoft is 2.53 trillion US dollars, Intel is about 204.1 billion US dollars; Microsoft’s market value has caught up with Apple’s market value at the end of October, 12 times that of Intel! Not only that, the market value of Intel is not comparable to Nvidia’s US$745.6 billion, and it has been chased by Broadcom (ticker: AVGO), which is really unimaginable. Moreover, the market value of AMD, which has been going bankrupt and is close to the delisting crisis (just 6 years ago, it fell to 1.66 in September 2015) has also reached 166.1 billion US dollars; the gap between Intel and AMD is not very far.

Figure 2: Share price chart of Nvidia (purple line), AMD (light brown green line), Microsoft (orange line), Intel (dark brown green line) over the past ten years (from Charles Schwab)

Why such a strikingly different development?

If we look closely, we can easily find the reasons for this: the leadership team of the company, the software trend of subscription and SaaS (software as a service), and the business model of the semiconductor central processing unit has changed; it’s all about these three factors.

Intel has changed three CEOs in three years

As mentioned earlier, Intel has changed three CEOs in the past three years. The high-level changes will impact company operatoin, morale, and strategy changes, not to mention any long-term development, innovation and R&D, competitiveness research, and performance review. Seriously, even the operations of small businesses will be shut down, let alone the world’s largest listed semiconductor company. Since its establishment, Nvidia has been focusing on the technology of discrete graphics display chips under the successful leadership of Jensen Huang, who is full of fighting spirit and energy. As for AMD, so far most people agree that Lisa Su took office in 2014, bringing AMD back to life and changing AMD’s fate.

Software Subscription and SaaS

The two most obvious trends in the software industry in the past decade are subscription and SaaS, and almost all software companies embrace these two must-have industry trends. In contrast, if you hesitate a little or fail in transformation, almost all of them will be fatally hit. The most obvious example is Oracle (ticker: ORCL), the world’s second largest software company, which was once stunned ten years ago. You can check the changes in the company’s stock price over the past 20 years to understand the price it paid for its unsuccessful cloudification.

ARM captures 85% of the processor market

Twenty years ago, no one would have thought that ARM has captured 85% of the total processor market; including mobile phones, tablets, desktop computers, laptops, and processors used in data centers.

Apple’s launch of its own M1 CPU in 2021 will immediately cost Intel nearly 10% of the PC CPU market. This is not the worst. Twenty years ago, the entry barrier for personal central processing units was very high, almost a monopoly of Intel, but now?

Not only does Microsoft no longer dominate Intel’s near-exclusive x86 CPU, it has allowed ARM CPUs from manufacturers such as Qualcomm (ticker: QCOM) to run Windows (obviously this will widen Microsoft’s moat, but it will weaken the Intel’s competitiveness). The Chromebook personal computers of Alphabet which has emerged in recent years, are treated equally, allowing CPUs produced by Intel, AMD, Qualcomm, and MediaTek to execute.

What’s worse is that in the x86 server CPU market, where Intel used to have nearly 99% market share and extremely high profits, in addition to the existing competitor, AMD, its customers have already developed or are developing their own server processors. These customers include Amazon (ticker: AMZN), Alphabet (tickers: GOOGL and GOOG), Alibaba (ticker: BABA), Microsoft, Nvidia, Tencent (ticker: TCEHY), Huawei, Xiaomi, all have entered this market.

All this at least proves one thing – Intel’s competitiveness has been weakened, which is an irrefutable fact. And the point is that the business model of semiconductor central processing units has changed completely, and the most fatal change is that this change is irreversible for a long time. For an in-depth discussion of this section, see my blog post “Intel’s current difficult dilemma.

And the situation is really bad, because there is an open-licensed RISC-V platform (mobile phones based on ARM processors must pay royalties), SiFive, Ampere, a new generation of central processor design manufacturers, Chinese technology giants are all ready to eat into the market pie that was almost monopolized by Intel 20 years ago.

All but Intel did the right thing

Microsoft and Nvidia have embraced the rapid development trend of the technology industry in the past decade and have achieved great success. Among them, Microsoft still sees no strong enough competitors to shake its monopoly position in the foreseeable future, for the existing Windows and Office.

Not only has it kept up with the current cloud computing and subscription system in the software industry, it has become a leader in the market, because “the basic services of cloud computing can almost be said to be a modern operating system.” Even more terrifying is that Microsoft has already launched, or will launch next year, and updated product lines that have embraced the latest metaverse trends in the tech world.

As mentioned above, Nvidia has no strong enough rivals in the existing discrete display chips and professional graphics chips (Nvidia has long-term covered more than 80% of the market, AMD occupies the rest of the market, and Intel is zero) , in the new generation of artificial intelligence, big data, cloud computing, cryptocurrency, self-driving, and the metaverse are almost all leader.

It can be said that “Nvidia is changing the computing method of the industry.” Anyone who has the ability to change the rules of the industry game in the capital market is destined to have bright business prospects and a strong moat, which explains why Nvidia can quickly ascend to the throne of the global semiconductor market value in just a few years. For an in-depth discussion of this section, see my blog post “How does nVidia make money, Nvidia is changing the gaming rules“.

In contrast, Intel is standing still; the main market has been repeatedly eroded by a large margin, and it is unable to open up any new sources of large revenue (Microsoft, Nvidia, and AMD have repeatedly expanded their own revenue. source). This back and forth is completely displayed on the changes in the market value of these three companies (Figure 2).

Only twenty years ago, Microsoft went through the period of “any personal computer and server use almost all Intel processors, but the software running on it is not necessarily Microsoft Windows” (because there are 8% to 10% implementing Apple’s operating system, plus other operating system software of about 5-10%) about a decade of painful periods of stagnant revenue growth. Today, “a significant percentage of PCs and servers running Microsoft Windows and Apple OS X are no longer Intel CPUs”; and the situation is only going to get worse.

In short, Microsoft, Nvidia, and AMD all “did the right thing” in the general direction, but Intel is even the basic skill of “doing things right” (the chip process is two generations behind TSMC). Not doing it well, let alone doing the right thing.

Long-term outlook

Intel

However, Intel’s worst case is probably the current situation, and it will not be getting worse further. The United States also cannot afford to lose it, and it is impossible to die without saving it. It is not an exaggeration to say that it is too big to fail. Didn’t you see that the US government started to use every means to help it recover? Including congressional budget support, tax relief for factory construction, threats to provide operating secrets from Asian chip manufacturers, factory construction support from European allies, chip orders from the US military, and foundry for large customers such as Qualcomm.

If Intel can really come back to life and return to glory this time, the prospects will be very bright, and it will not be a problem to recreate the glory of another two or three decads. But the question is how long do investors have to wait for Intel? Please refer to my blog post “How does Intel make money? and the benefits to invest in it?“, “Intel’s current difficult dilemma“, “Will Intel go bankrupt?“, for detail discussion.

Microsoft

Microsoft’s position in the enterprise software market seems to be very stable at present. The product line has been greatly strengthened compared with ten years ago. It is no longer a company that only had Office and Windows more than ten years ago. It has the ability to endure large-scale challenges or market shock. For this part, please see my previous blog post “How Does Microsoft Make Money?” Where is the future?” on this topic.

AMD

As for AMD, it would not be an exaggeration to say that this is the peak of the company’s momentum since its establishment, but its future destiny depends on how long Intel can get back on track, because semiconductor manufacturing is still a capital-intensive and cyclical commodity industry. Once Intel came back to life and caught up with the backward situation in the manufacturing process, Intel has advantages in production and resources, and will inevitably adopt a large-scale dumping strategy. And in one year, or two years later, the global chip shortage will definitely be relieved, all of which are very unfavorable to AMD. See this discussion on my previous blog post, “How AMD makes money? A rare case of turning defeat into victory” and “Why is AMD’s performance so jaw-dropping?“

Nvidia

Nvidia, on the other hand, is almost a leader in the new generation of artificial intelligence, big data, cloud computing, cryptocurrencies, self-driving, and the metaverse, and will remain the leader for a not-so-short period of time (at least 5 years). In the long run, it will have to be seen whether these next-generation technologies can continue to shine; but the outlook is generally bright.

I am the author of the original text, the abridged version of this article was originally published in Smart monthly magazine.

Related articles

- “The rebirth and fall of 4 major technology stocks in 10 years“

- “Satya Nadella brings Microsoft back to glory“

- “Microsoft, the real overlord of cloud computing“

- “Microsoft buys the game master of the PC era, Active Vision Blizzard“

- “How Microsoft makes money? Where is the future?“

- “Is Microsoft’s personal computer computing department a tasteless one?“

- “Comparison of TSMC, Samsung, Intel’s Yield and Advanced Process“

- “Comparison of TSMC, Intel, and Samsung’s new process roadmaps for future chips“

- “Will Intel go bankrupt?“

- “How does Intel make money? and the benefits to invest in it“

- “Intel’s current difficult dilemma“

- “How AMD makes money? A rare case of turning defeat into victory“

- “Why is AMD’s performance so jaw-dropping?“

- “Qualcomm diversifies success, no nonger highly dependend on phone“

- “How does nVidia make money, Nvidia is changing the gaming rules“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.