This article describes 7 key factors to Buffett success: Charlie Munger made a very important speech at the beginning of the 2007 Weisco shareholders’ meeting and the Q&A discussion with shareholders.

Category: Jim Simons

“How to Invest”

“How to Invest” was written by David. Rubinstein interviewed 24 famous investors. These 24 famous investors came from different investment fields. They are all top-notch business founders or investors in their respective fields and are very representative. I hope readers can gain inspiration for getting rich from the heartfelt advice given to other investors by 24 famous investors.

The quant’s must-read book for Jim Simons “The Man Who Solved the Market”

I personally rarely believe in investment geniuses or gurus hyped. Buffett and Munger are. The semi-autobiography “The Man Who Solved the Market” for Jim Simons that I want to talk about today is another person who is full of mystery, but his investment achievements can’t help but awe me.

Commonalities in Quantitative Investment

If you want to enter the field of quantitative investment without having financial background, as long as you study hard and find someone to help you, you will be able to change your life. However, whether one is smart or not is not impossible to make up for through acquired learning.

Jim Simons, the lord of quantitative investing

In 36 years, Jim Simons achieved an astonishing annualized return of nearly 40%. This is the best performance of any known investment guru today. For this part, please see my previous post: “The career annualized return on investment of top investment masters”.

The career annualized return on investment of top investment masters: Buffett, Simons, Lynch, Dalio, Keynes, Munger, Soros, Miller, Karaman, Graham

The career annualized return on investment of top investment masters: Buffett, Simons, Lynch, Dalio, Keynes, Munger, Soros, Miller, Karaman The criteria for the investment masters selected in this article mainly include the following.

Market volatility is investors’ friend

Market volatility is investors’ friend, The only certainty in the stock market is uncertainty

The Psychology of Money

The Psychology of Money, Why recommend this book? “The Psychology of Money” is a book about money and wealth by Morgan Housel. This book is about some classic financial and investing ideas, such as Nassim Taleb, Daniel Kahneman and Warren Buffett.

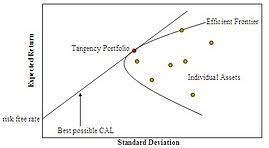

Why Modern Portfolio Theory Unreasonable?

Why Modern Portfolio Theory Unreasonable? The inventor himself did not use it. I should have computed the historical covariance and drawn an efficient frontier. Instead I visualized my grief if the stock market went way up and I wasn’t in it – or if it went way down and I was completely in it. My intention was to minimize my future regret, so I split my [retirement pot] 50/50 between bonds and equities.

Retail investors’ wrong investment concept not worth trying at all

Investment concept not worth trying at all