Most investors have the mentality of being afraid of fear of miss out (FOMO) excellent companies. This is a normal human reflection and there is nothing to avoid. But in fact, you don’t need to be like this.

Why don’t you need to be afraid?

- Only concentrated investment and long-term investment can make a lot of money: For long-term investment (see “Why Long-term Investment?” for details) and concentrated investment (see “Why Centralized Investment?” for details), the selection of investment companies will be incomparable cautious, of course, you will miss some excellent companies. Our strategy is to minimize the chances of missing out and increase the chances of choosing excellent companies to increase the chance of investing success.

- There are nearly 12,000 U.S. stocks that can be traded, and hundreds of new companies will go public every year. There are unlimited opportunities. Investors don’t have to worry about gains and losses. Investors always have opportunities.

- A super-excellent company will still be a super-excellent company after three or five years. Just give a few examples, if you missed Apple (ticker: AAPL) and Microsoft (ticker: MSFT) previously (the reason may be that you were not born in the year of Apple and Microsoft’s IPO, or you had limited funds at that time, or you made a mistake in judgment); even now, Apple and Microsoft are still worth investing. Interested investors could refer to my previous blog article “Five major technology stocks for getting started in US stocks“.

- Super-excellent companies are rare, and this is the premise. For details, see my blog article “Good companies are rare, two or three will make you very rich“

- People are born from generation to generation. Without immortal enterprises, the moat cannot exist forever.

Refusal to be forced to trade

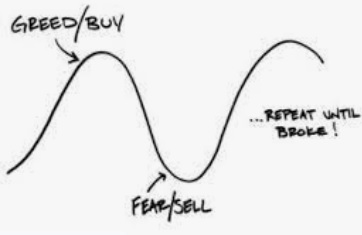

The result of any forced transaction is terrible; in order to raise the redemption pressure of investors during the crash, fund managers had to repeatedly clear the stocks at the lowest market price, and the result was to accelerate the market decline. In a bull market, all retail investors who have not entered the market for several years are eager to get on the train, afraid of missing the train to get rich.

The result is often at the highest point in the stock market, buying stocks at sky-high prices. Or chasing the red-hot IPO stocks that everyone in the market has crazily lined up, hoping to bet on the next Apple or Microsoft with the mentality of a gambler. Chasing the red-hot IPO stock, or want to get on board ASAP and ignore the irrational sky-high price are destined to be impossible to get good returns.

Trade only if it meets the principles

Instead, successful investors should be disciplined, be sure to invest only within their own circle of competence, and wait patiently for their favorite and very sure investment targets to appear in the market, when they determine the possibility of generating considerable returns, then bet all the chips in your hand.

It is conceivable that such opportunities are rare; because it may take a few years for such a company to go public, or companies on your long-term watch list are short-sighted and abandoned by the market due to short-sightedness of investors, and their share prices are at irrational record low. The typical moment is you may only find such an opportunity when the stock market crashes once in a decade. Under these circumstances, you can have a sufficient margin of safety. At this time, there are very few people. You can buy unrecognized jade or gold stained with dust at a very low cost.

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.