As of May 20, 2024, Vertiv’s stock price return in the past year exceeded 501%, surpassing the 204% of Nvidia, the king of artificial intelligence chips, and can be called the low-key growth champion of the US stock market.

Author: Andy Lin

Munger’s most important work “Poor Charlie’s Almanack”

“Poor Charlie’s Almanack” is a must-read book if you want to understand Munger’s life “thoughts”. The focus is not on investment, but on Munger’s philosophy of life. The content is very rich. I would like to remind everyone that this book is actually very difficult to read and is not suitable for everyone to read.

What company is Nubank owned by Buffett? How it makes money and its advantages?

If Nubank meets all conditions, the company continues to operate smoothly, and the overall environment in Latin America improves, perhaps Nubank “has a chance (but it may not happen)” to become Latin America’s version of Block (formerly known as Square, ticker: XYZ) Or the potential of PayPal (ticker: PYPL ).

Andy Indices will be daily updated on the homepage

The three numbers of Andy Indices are based on yesterday’s closing performance of the US stock market and will be automatically updated every day on the upper left corner area of the homepage of this website (granitefirm.com, not granitefirm.com/us/).

Wingstop’s astonishing growth is unprecedented in the restaurant industry

There is nothing new or special about the chicken wings segment that Wingstop focuses on. But the stock price growth over the past few years has been astonishing and breathtaking!

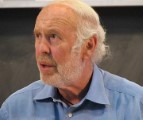

Jim Simons, the lord of quantitative investing

In 36 years, Jim Simons achieved an astonishing annualized return of nearly 40%. This is the best performance of any known investment guru today. For this part, please see my previous post: “The career annualized return on investment of top investment masters”.

The Third Anniversary Review: Top 20 read articles in Andy Lin’s blog

The Third Anniversary Review: five of the list ever appeared in the top twenty list in the past three years

2024 Berkshire shareholders meeting transcript and video

2024 Berkshire shareholders meeting transcript and video, links, in English and Simplified Chinese

Supermicro, a repeat offender of scandals, valuation is not justified and unsustanable, no worth for long-term holding

Supermicro has absolutely no autonomy in its business, no moat, ultra-low profit margins, and has been involved in negative scandals “repeatedly”. Competitors are too powerful—it is not recommended to hold it.

Famous organizations linked Andy Lin’s blog articles

This article will list the “more famous” organizations’ that linked from my blog article.