Over the past 40 years, Buffett has disclosed Buffett’s Acquisition Criteriamany times through the annual shareholder letter and the company’s website.

Category: Investing Guru

Investors should not trust forecasts

Buffett admits he has no ability to forecast, manipulated numbers must not be honored, if forecasts cannot meet, and the result is only fake.

Derivatives are time bombs, several well-known cases

Buffett spent a long time explaining to investors in his 2002 shareholder letter: Why does he think derivative financial products are time bombs?

Share repurchase keep share price underpinned

actively carry out share repurchases can make the company’s stock price obtain obvious support in a bear market, which is more resistant to falling than other stocks.

How Buffett Structures His Long-Term Investment Portfolio

In his 1996 shareholder letter, Buffett explained in great detail how he structured his long-term investment portfolio. Many of the contents of this letter have been quoted repeatedly so far, and it can be regarded as a very important shareholder letter.

Money-losing companies in the US stock market has always been the norm

Many people think that the U.S. stock market has become a money-losing company in recent years? the answer is negative.

What are the risks investors should face up to?

Buffett explained in detail the risks that stock market investors should face up to and why they should invest in the broader market index.

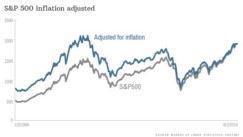

Why do stock prices automatically rise with inflation?

When inflation, prices raised, the revenue will increase according to the ratio of the price increase, and of course the net profit will also increase. The increase in revenue and net profit will naturally push up the stock price; because the valuation of the stock Will automatically increase with the increase in revenue and profit

Why do stock funds perform so poorly? How bad is it?

Facts speak louder than words. 79% to 85% of US stock fund performance will lag behind the stock market in the long-term.

How do monopolies or oligopolies work in the real world?

In the real world, there will be no perfect competition, but monopolies or oligopolies enterprises