Book Highlights

The value of this book

After reading Dear Shareholder, I was reminded of “Outsiders” which I introduced on this blog. The two books have a lot in common, except that this book starts from the perspective of a shareholder letter, while “Outsiders” focuses on the managers of enterprises.

The only pity of this book is that it is not in-depth enough, but this is understandable, because in one book, there are 16 shareholder letters from CEOs, which are too many, and each of them is a well-known heavyweight company. Impossible to go too deep. The author has actually done his due diligence. I personally think that after reading this book, investors can directly go to the relevant books of the company you are interested in, or directly download the English shareholder letter of the company for research.

Book author

The author of this book is Lawrence A. Cunningham, who has written many famous books about Buffett, one of the most famous is “The Essays of Warren Buffett“. A must-read for investors who want to understand Buffett’s investment philosophy.

The commonlarity of these shareholder letters

Although the author points out a few at the beginning of the book, I don’t want to copy the author’s point of view.

It is certainly no coincidence that the shareholder letters of the CEOs in this book have many things in common. The key points of these CEOs in their shareholder letters are actually talking about the same things. I think this is the essence of this book, and investors should pay special attention to these things.

Capital allocation

I have spent a lot of time discussing this part in Chapter 6 of my new book, “The Rules of 10 Baggers“. Interested investors can refer to the content of my book.

Capital allocation is a topic that young investors, short-term investors, or general investors are not very familiar with, but it is an important factor affecting the long-term value and stock price performance of a company. If you’re really not sure, take the time to understand what capital allocation includes and why it matters.

Long-term value

The main reason that these companies and CEOs are successful is that they emphasize only one thing—they focus on three things:

- Long-term value, ignore short-term goals

- Seek to maximize the intrinsic value of the enterprise

- Create maximum benefits for shareholders

If you really have a hard time buying into long-term investing, your chances of making big money in the stock market are slim to none. You may doubt it, the famous companies in this book are all evidence!

Stock performance are amazing

But it’s easier said than done. They all prove with actual results that the long-term stock price returns of these related companies are extremely amazing. The most difficult thing is that the time span of discussion and performance measurement of all the companies mentioned is based on twenty years. Minimum Standards. That’s the biggest reason I’m interested in them. I will list the annualized rate of return of these companies in the past 20 years as evidence, because as I mentioned in my previous article, “Investors should care annualized rate of return (IRR), How to calculate?”

The famous shareholder letters

Since this book discusses shareholder letters from 16 CEOs, I’m not going to discuss them all. The list of shareholder letters from the CEOs of the companies listed in this book is as follows. I add the ticker after the company name, the company’s long-term annualized rate of return (aka IRR, mainly based on the figures in the book), and some related articles of this company or the CEO for your reference:

Warren Buffett

- Berkshire Hathaway (tickers: BRK.A, BRK.B)

- From 1964 to 2018, the average annualized return on company stocks was 20.5%

- “Why Buffett deserves further study” , “The commonalities of Buffett portfolio – cheap, fixed income, repurchase” and “Warren Buffett’s Ground Rules“

Roberto Guzveta

- Coca-Cola (ticker: KO)

- “Coca-Cola has been inferior to Pepsi in and even return rate is negative in past 10 years!“, “Pros and cons of investing in Coca-Cola“

Prem Vaasa

- Fairfax Financial Holdings (ticker: FRFHF)

- From 1985 to 2018, the average annualized return on the company’s stock was 17.1%

Ian Cumming, Joey Steinberg, Richard Handler and Brian. Freeman

- Leucadia National. In 2018, the company changed its name to Jefferies Financial Group (ticker: JEF)

- From 1979 to 2012, the average annualized return on the company’s stock was 19.3%

Don Graham and Tim Oxanasi

- The Washington Post (acquired by Amazon’s Jeff Bezos)

Jeff Bezos

- Amazon ( ticker: AMZN)

- “Why Amazon acquired MGM?“, “Amazon vs. Alibaba“, “Amazon’s dominance by its economic scale, impact share price of PayPal, Affirm, Fair Isaac, Visa, and Mastercard“

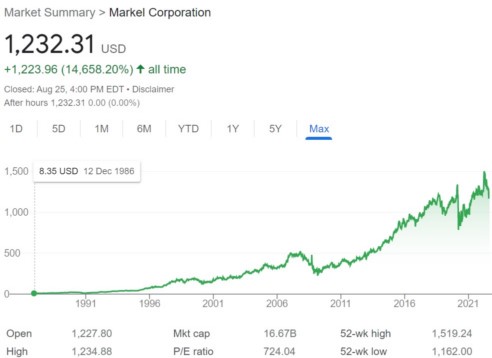

Steve Markel and Tom Gaynor

- Markel Corporation (ticker: MKL)

- Over 20 years, the company’s stock has an average annualized return of 9%

Charles Fabicon

- SEACOR Marine (ticker: SMHI)

- From 1992 to 2018, the average annualized return of the company’s stock was 9.2%

Brett Roberts

- Credit Acceptance Corp. (ticker: CACC)

- From 1992 to 2017, the average annualized rate of return of the company’s net profit was 21.12%

Larry Page and Sergey Brin

- Alphabet (tickers: GOOGL, GOOG)

- “Consider Alphabet if you can buy one stock only to retire from it? “, “Alphabet’s urgent crisis“

Joe Mansuto and Connor Kabu

- Morningstar (ticker: MORN)

- From 2005 to 2018, the average annualized return on the company’s stock was 15.1%

- “Any strong reason to buy mutual fund?“

Mark Leonard

- Constellation Software (ticker: CNSWF)

Indra Nooyi

- PepsiCo (ticker: PEP)

- “Coca-Cola has been inferior to Pepsi in and even return rate is negative in past 10 years!“, “Pros and cons of investing in Coca-Cola“

Weston Hicks

- Alleghany (ticker: Y)

- In 15 years, the average annualized return of the company’s stock is 8.4%

Ginny Rometty

- IBM (ticker: IBM)

- “How does IBM make money? What is the focus of the future?”

Rob King

- Cimpress (ticker: CMPR)

Company deserved research

Here, I would like to recommend that investors, in addition to Buffett’s Berkshire Hathaway, long-term investors can study the company of Berkshire’s Markle. You’ll find Berkshire everywhere when you study it. His 20-year stock has an average annualized return of 9%. Here’s a chart of its stock price since it went public (as of 8/25/2022).

Relative articles

- “Investors should care annualized rate of return (IRR), How to calculate?“

- “2024 Berkshire shareholders meeting transcript and video“

- “Buffett’s 2023 Annual Shareholder Letter“

- “Buffett’s 2024 Annual Shareholder Letter“

- “2023 Berkshire shareholders meeting transcript and video“

- “Charlie Munger speaks at 2023 Daily Journal Shareholders Meeting“

- “Dear Shareholder“

- “Buffett’s first TV interview“

- “Outsiders, one of the greatest investment books for managment team“

- “Full transcript of Buffett’s interview with CNBC’s Squawk Box“

- “Outsiders, one of the greatest investment books for managment team“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.