It’s not easy to set trends, but if this company is a game changer in the computer industry, you know how important it is.

Nvidia discussion in my books

I have discussed the company Nvidia (ticker:NVDA) in two recent books; including:

In my book “The Rules of Super Growth Stocks Investing“:

- Section 3-3, pp. 190-191

- Section 3-7

In my book “The Rules of 10 Baggers“:

- Section 1-1, pages 23-24

- 5-6, pages 242-246, an entire subsection dedicated to this company

- Section 6-2, pages 282-285

- Section 7-1, pp. 348-285

Amazing performance in the past 5 years

I mentioned the analysis of this company in section 3-3 of the book “The Rules of Super Growth Stocks Investing”. The investors are very smart and have made a fair evaluation of this company. Let’s first look at the stock price performance of nVidia (ticker: NVDA) over the past five years-1,566.94%.

Figure 1: nVidia stock price performance in the past 5 years; Source: Google Finance

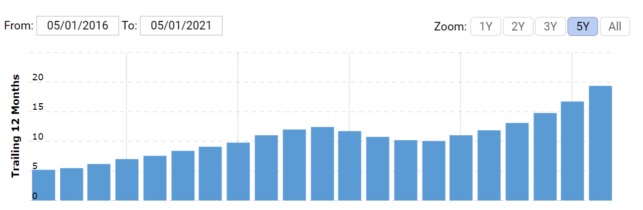

In the most recent year, nVidia’s annual revenue for fiscal year 2021 was 16.675 billion U.S. dollars, compared with 5.01 billion U.S. dollars in the 2016 fiscal year five years ago, a five-year growth of ─ 232.83%.

Figure 2: nVidia quarterly revenue in past 5 years, data from macrotrends.net

Please note that this is the performance within 5 years; nVidia can be said to be the most amazing performance among all large-scale hardware listed companies in the US stock market. What about its other financial figures? (Until the first quarter of 2021)

- Long-term debt is 5.964 billion US dollars, a year-on-year decrease of 14.3%

- Cash on the account is 12.667 billion US dollars, a year-on-year decrease of 22.54%

- Gross profit margin 62.43%, operating profit margin 28.62%, net profit margin 27.66%

- Current ratio of 4.53, quick ratio of 4.03

- ROE is 32.82%

- Long-term debt ratio 0.64

Current valuation

What about its current stock price valuation figures? (Value as of June 23, 2021)

- Market value of 474.91 billion U.S. dollars

- Price per market 762.69

- The P/E ratio is 90.34

- The price-to-revenue ratio is 24.92

- EV/EBIDTA is 65.9

Outperformed major large technology stocks

All operating financial figures can only be described as “impeccable”, and the valuation of the stock price given by investors can only be compared with the word “crazy” (why? Readers can refer to the “The Rules of Super Growth Stocks Investing” section 4-2 for detail). But judging from the current performance of this company in all aspects, it is really well-deserved!

If we cover up the name of the company, readers might still think that this article discusses which US stock software, e-commerce, or financial startup giant? But it’s not–it’s a typical semiconductor hardware vendor, and all its operating data, financial data, and stock price valuations are compared to the top five companies in the U.S. stock market by Apple (ticker: AAPL) and Microsoft ( ticker: MSFT), Alphabet (ticker:s: GOOGL and GOOG), Amazon (ticker: AMZN), Facebook (ticker: META).

The leader of all technological trends

If you ask what are the hottest industries and investment fields in the technology industry , most people will give the following answers:

- Online games, e-sports, game consoles

- Artificial intelligence

- Cloud computing

- Big data and data center

- Self-driving

- Cryptocurrency

- Metaverse

nVidia is such a technology giant with leading technologies in all the above-mentioned fields. The most important point is that it is almost a recognized leader in the above six hottest technology fields, and it is not a part-time player. It is not easy to get involved in these six areas at the same time, not to mention that almost all of them are industry leaders, so it is not accidental that it can be sought after by Wall Street.

| Area | nVidia’s achievements, market share, plan | Revenue percentage | Main competitors |

| Online game and eSport | More than 80% of the market for discrete graphics cards necessary for game and eSport players | 47% | AMD, Intel |

| Professional graphics card | Quadro, a professional display and drawing platform in an almost monopoly industry | 6% | AMD |

| Gaming console | The most popular Nintendo game console uses its platform | AMD | |

| Cloud computing, artificial intelligence, big data, data center | HGX and DGX high-speed computing, artificial intelligence, accelerated computing, data center computing platform DPU Bluefield, the world’s smallest artificial intelligence computer Jetson Nano | 40% | Intel, AMD, Alphabet, Amazon, Microsoft |

| Self-driving | Developed Jetson based on Tegra, successfully applied the expertise of mobile computing, low power consumption, professional image processing, and parallel processing to the field of self-driving cars, and launched the Drive platform | 3% | Intel, Alphabet, Tesla |

| CryptoCurrency | Make GPU the first choice for miners other than non-professional ASIC chips, and launch CMP (cryptocurrency mining processor) | AMD, CryptoCurrency mining company | |

| Metaverse | nVidia’s Omniverse cloud native platform provides functions such as realistic rendering effects, audio input/facial animation output, amazing visual effects, and AI support provided by RTX | AMD, Unity, Epic Games, Roblox |

Overlord of AI and data center accelerators

nVidia invented the computer display concept of GPU discrete graphics card in the 1990s, and it has been widely adopted by the industry. After discrete graphics cards have substantially monopolized the market for almost a long time, in order to find the company’s next source of revenue. In the era of turbulent mobile device field battles in the mobile phone and tablet technology industry from 2011 to 2014, nVidia also came back in defeat and defeated.

However, the founder of nVidia, Huang Jen-Hsun, demonstrated his unrelenting perseverance. In just two or three years, he reorganized his team, correctly judged the trend of technology, and applied nVidia’s best and most fundamental GPU technology to artificial intelligence, cloud computing, big data and data centers, cryptocurrency mining and other different fields, and also transferred the Tegra platform used by failed mobile devices to the field of game consoles and self-driving cars. To make the company successful in its transformation, to achieve substantial leadership and amazing achievements in these hottest technology fields, and to bring enviable profits to the company.

Push Intel to the corner

Just look at how Intel has been pushed to the corner in recent years. Not only has its market value been significantly behind nVidia (see Figure 3: Comparison of nVidia and Intel’s share price performance in the past five years); it has also changed three CEOs in less than three years (Intel has only had 8 CEOs since its establishment 54 years ago, and nearly three of them have been replaced in the past 3 years. Everyone knows how serious Intel’s internal situation is). Recently, the data center department was reorganized (the department with the highest market share and profit of Intel, and the department most threatened by nVidia), and launched a new IPU to face nVidia.

Figure 3: Comparison of nVidia and Intel’s share price performance in the past five years (source: Charles Schwab)

Future outlook

Regardless of whether the ARM M&A case can pass the antitrust review of various countries (currently it seems that the probability is very low), nVidia’s achievements and moats in the new computer application field have been formed, and it is difficult for a competitor of the same level to be comprehensive to catch up in the short term. And Huang Jen-Hsun is only 58 years old now! nVidia has amazing competitiveness, because it is changing the way of calculation! – That is the gaming rule of this industry . Changing the gaming rules is difficult in any industry, but nVidia managed it.

Postscript

As I said, Nvidia’s ARM acquisition was not successful; interested friends can refer to my other blog article “Why is no one happy to see nVidia acquisition of ARM?“.

Related articles

- “Top vendors and uses of GPU“

- “How does nVidia make money, Nvidia is changing the gaming rules“

- “The reasons for Nvidia’s monopoly and the challenges it faces“

- “Why nVidia failed to acquire ARM?“

- “Revisiting Nvidia: The Absolute Leader in Artificial Intelligence, Data Center, and Graphics“

- “TSMC negative corp culture and management style are detrimental to its future and growth“

- “Artificial intelligence benefits industries“

- “Four chip companies account for one-third of S&P 500 gains so far this year

- “Top five lucrative artificial lucrative intelligence listed companies“

- “What’s TSMC DCF intrinsic value?How to calculate it quickly with a free tool?“

- “How many fabs and houses does TSMC have currently and in the future?“

- “Comparison of TSMC, Samsung, Intel’s Yield and Advanced Process“

- “The TSMC cost, sell price, and R&D cost of chip foundry“

- “ASML, who dominate TSMC’s fate“

- “Comparison of TSMC, Intel, and Samsung’s new process roadmaps for future chips“

- “Two long-term threats to TSMC: US and SMIC“

- “Why is TSMC’s profit margin much greater than competitors?“

- “How does TSMC make money?“

- “Zyvex and sub-nanometer semiconductor processes, will Zyvex threat TSMC?“

- “TSMC gets emerging and serious challenges“

- “ASIC market is getting bigger, and related listed companies in the US and Taiwan“

- “Will Intel go bankrupt?“

- “How does Intel make money? and the benefits to invest in it“

- “Intel’s current difficult dilemma“

- “How does Texas Instruments make money? Amazing long term capital reward and company net profit margin!“

- “How AMD makes money? A rare case of turning defeat into victory“

- “Why is AMD’s performance so jaw-dropping?“

- “Qualcomm diversifies success, no nonger highly dependend on phone“

- “How does the ubiquitous Arm make money?“

- “Significant changes in Broadcom’s business approach“

- “Data center, a rapidly growing semiconductor field“

- “How does Applied Materials, lord of semiconductor equipment, make money?“

- “The lucrative semiconductor supply chain“

- “Global semiconductor chip market in detail, big dominators and markets“

- “6 common wrong semiconductor investment myths“

- “Gen 3 semiconductor“

- “Three EDA oligopoly vendors: Synopsys, Cadence, and Mentor Graphics“

- “How does, the EDA oligopoly, Cadence make money?“

- “How does Synopsis, the EDA oligopoly, make money?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.