TSMC discussion in my books

I have discussed the company Nvidia (ticker:NVDA) in two recent books; including:

In my book “The Rules of Super Growth Stocks Investing“:

- Sections 2-4, the entire section is dedicated to introducing the company TSMC

- Section 3-3, analyze the business development of technology companies to grasp the pulse of key industries

In my book “The Rules of 10 Baggers“:

- Section 3-2, the entire section is dedicated to introducing TSMC and the global semiconductor supply chain.

Introduction

Company profile

Established in 1987 and headquartered in Hsinchu, Taiwan, TSMC pioneered the pure-play foundry business model with an exclusive focus on manufacturing customers’ products. By choosing not to design, manufacture or market any semiconductor products under its own name, the Company ensures that it never competes with its customers.

Business scope

TSMC described its business scope in its annual report as:

TSMC provides a full range of integrated semiconductor foundry services, including leading advanced process, specialty technologies, advanced mask technologies, 3D Fabric advanced packaging and silicon stacking technologies, excellent manufacturing productivity and quality, as well as comprehensive design ecosystem support, to meet a growing variety of customer needs.

Customer Applications

Customers’ chips were used across a broad spectrum of electronic applications, including computers and peripherals, information appliances, wired and wireless communication systems, high-performance computing servers and data centers, automotive and industrial equipment, as well as consumer electronics such as digital TVs, game consoles, digital cameras, AI-enabled IoT and wearables, and many other devices and applications.

Key statistics

| Year 2021 data | Numbers |

| Number of customers | 535 |

| Products | 12,302 |

| Capacity | 13-14 million 12-inch equivalent wafers |

| Output | 14-15 million 12-inch equivalent wafers |

| Amount | USD 27,770.49 million |

Top 10 customers

The following is made by Digitimes citing data from Bloomberg, but I would like to remind readers that TSMC only publishes the revenue contribution from top two customers without customer names in the annual report. And the second place’s revenue share is 10%, not Bloomberg’s 5.8%.

| Year 2021 | Revenue contribution |

| Apple | 25.93% |

| Mediatek | 5.8% |

| AMD | 4.39% |

| Qualcomm | 3.90% |

| Broadcom | 3.77% |

| Nvidia | 2.83% |

| Marvell | 1.39% |

| STMicroelectronics | 1.38% |

| ADI | 1.06% |

| Intel | 0.84% |

Business and stock performance

2021 full year performance

| 2021 | TSMC | Intel |

| Annual revenue and growth ($ million) | 57,231 +20.15% | 79,024 +1.49% |

| Annual gross income and growth ($ million) | 29,546.7 +16.82% | 43,815 +0.465% |

| Annual operating income and growth ($ million) | 23,443.6 +16.3% | 22,082 -7.51% |

| Annual net income and growth ($ million) | 21,507 +16.77% | 19,868 -4.94% |

| Gross margin | 51.63% | 55.45% |

| Operating margin | 40.96% | 27.94% |

| Net margin | 37.58% | 12.49% |

Stock valuation

| 7/15/2022 | TSMC | Intel |

| Market capitalization ($ billion) | 430.12 | 157.92 |

| Share price | 85.6 | 38.62 |

| P/E | 20.07 | 6.42 |

| Dividend yield | 2.22% | 3.78% |

| Stock performance in past 5 years (S&P 500 +57.54%) | 138.86% | +11.2% |

2022 Q2 results

Business performance vs. previous period

| Metric | FY 2019 | FY 2020 | FY 2021 | Q1 2022 | Q2 2022 |

| Revenue growth* (YOY) | 1% | 31% | 25% | 36% | 37% |

| Percentage of revenue (5nm) | 0% | 8% | 19% | 20% | 21% |

| Percentage of revenue (7nm) | 27% | 33% | 31% | 30% | 30% |

| Gross margin | 46% | 53.10% | 51.60% | 55.60% | 59.10% |

| Operating margin | 34.80% | 42.30% | 40.90% | 45.60% | 49.10% |

Key numbers

GAAP earnings per share in the second quarter were $1.55 on revenue of $18.16 billion, an annual increase of 36.6%. The three major profit margins are gross profit margin of 59.1%, operating profit margin of 49.1%, and net profit margin of 44.4%. Based on my experience in tracking TSMC for more than ten years, it should be the best performance in the history of TSMC. Personally, I can only say that this kind of performance is very difficult to achieve.

Output

TSMC shipped 3.799 million wafers (12 inches) in this quarter, and its average single wafer shipment price was $4,780. The two figures were very close to the previous quarter, with only a slight increase.

Process technology

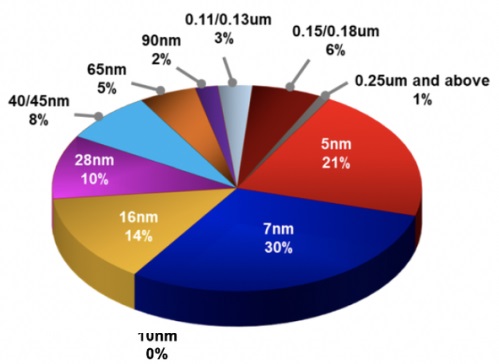

By process technology, 5nm orders accounted for 21% of sales, compared with 18% in the same period last year, and 7nm orders accounted for 30% of sales, compared with 31% in the same period last year; the details are shown in Figure 1 below.

Figure 1: TSMC 2022 Q2 process technology

Customer Applications

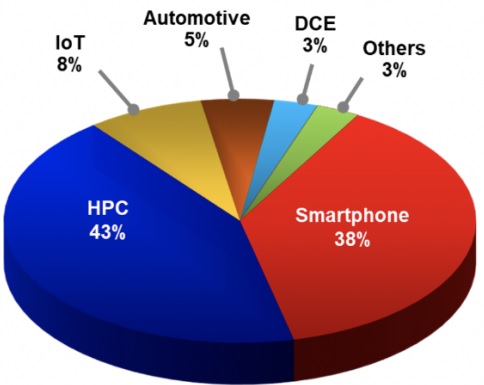

By end application, smartphone customers accounted for 38% of revenue, compared with 42% in the same period last year; high-performance computing customers (HPC) accounted for 43% of sales, compared with 39% in the same period last year. Automotive industry customers accounted for 5% of TSMC’s revenue, compared to 4% in the same period last year; details are shown in Figure 2 below.

Figure 2: TSMC 2022 Q2 customer spplications

Related articles

- “What’s TSMC DCF intrinsic value?How to calculate it quickly with a free tool?“

- “TSMC negative corp culture and management style are detrimental to its future and growth“

- “Four chip companies account for one-third of S&P 500 gains so far this year

- “Top five lucrative artificial lucrative intelligence listed companies“

- “What’s TSMC DCF intrinsic value?How to calculate it quickly with a free tool?“

- “How many fabs and houses does TSMC have currently and in the future?“

- “Comparison of TSMC, Samsung, Intel’s Yield and Advanced Process“

- “The TSMC cost, sell price, and R&D cost of chip foundry“

- “ASML, who dominate TSMC’s fate“

- “Comparison of TSMC, Intel, and Samsung’s new process roadmaps for future chips“

- “Two long-term threats to TSMC: US and SMIC“

- “Why is TSMC’s profit margin much greater than competitors?“

- “How does TSMC make money?“

- “Zyvex and sub-nanometer semiconductor processes, will Zyvex threat TSMC?“

- “TSMC gets emerging and serious challenges“

- “How does nVidia make money, Nvidia is changing the gaming rules“

- “The reasons for Nvidia’s monopoly and the challenges it faces“

- “Why nVidia failed to acquire ARM?“

- “Revisiting Nvidia: The Absolute Leader in Artificial Intelligence, Data Center, and Graphics“

- “How does Intel make money? and the benefits to invest in it“

- “Intel’s current difficult dilemma“

- “How does Texas Instruments make money? Amazing long term capital reward and company net profit margin!“

- “How AMD makes money? A rare case of turning defeat into victory“

- “Why is AMD’s performance so jaw-dropping?“

- “Qualcomm diversifies success, no nonger highly dependend on phone“

- “How does the ubiquitous Arm make money?“

- “Significant changes in Broadcom’s business approach“

- “Data center, a rapidly growing semiconductor field“

- “How does Applied Materials, lord of semiconductor equipment, make money?“

- “The lucrative semiconductor supply chain“

- “Global semiconductor chip market in detail, big dominators and markets“

- “6 common wrong semiconductor investment myths“

- “Gen 3 semiconductor“

- “Three EDA oligopoly vendors: Synopsys, Cadence, and Mentor Graphics“

- “How does, the EDA oligopoly, Cadence make money?“

- “How does Synopsis, the EDA oligopoly, make money?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.