Texas Instruments (aka TI, ticker: TXN) is an extremely important company among US listed companies, in many ways it is.

Moreover, this company is actually one of the inventors of the semiconductors we use now. This company is one of the few large technology companies not located in Silicon Valley, but it has a great influence on the development of the technology industry in the United States. It has been so until now. , and it should be in the future. For this part, please refer to the explanation of my other article “The Power Law“.

Texas Instruments discussion in my books

I have discussed the company Texas Instruments, relative industry or topics, in my latest two books; including:

In my book “The Rules of Super Growth Stocks Investing“:

- Sections 2-4, pp. 139-141, discussion on business efficiency

- Sections 3-7, p. 231, discussion on supply chains

In my book “The Rules of 10 Baggers“:

- Section 3-2, pp. 124-128, discussion on the semiconductor industry

- Section 6-7, page 323, discussion on capital operations of listed companies

- Appendix 3, page 394, discussion of Nifty 50

Company introduction

Company profile

Take Texas Instruments as an example; this company was founded earlier than Intel (ticker: INTC), for Intel, I suggest you refer to my previous blog post “How Does Intel Make Money? And the Benefits of Investing in It“

The great achievements of Texas Instruments

The achievements of Texas Instruments include the following notable ones:

- In 1958, Jack Kilby of Texas Instruments invented the integrated circuit, opening the way to modern semiconductors.

- Manufactured the world’s first commercial silicon transistor, the ancestor of modern silicon wafers.

- The world’s largest manufacturer of digital signal processors (DSPs) and analog semiconductor components.

- In 1954, Texas Instruments produced the world’s first transistor radio.

- In 1967, Texas Instruments invented the world’s first portable computer.

- The acquisition of National Semiconductor in 2011 cemented the global analog semiconductor throne.

- Texas Instruments was once the second-largest chip supplier for mobile phones, after Qualcomm (NYSE: QCOM).

Nurturing many semiconductor talents

Because of its long history, Texas Instruments has also trained countless talents for the global semiconductor industry, including Moris Chang, the founder of TSMC.

Operating Status

By product category

| Business Unit | 2021 Revenue ($ million) and Growth Rate | Account for Total Revenue | |

| Total revenue | 18,344 +26.85% | 100% | |

| Analog | 14,050+29.06% | 76.59% | |

| Embedded | 3,049 +18.64% | 16.62% | |

| Others | 1,245 +23.88% | 6.79% | |

| Gross income | 12,376 +33.52% | ||

| Operating income | 9,022 +52.27% | ||

| Net income | 7,769 +38.86% | ||

| Gross margin | 67.47% | ||

| Operating margin | 44.18% | ||

| Net margin | 42.35% |

By market

| Market | Account for total revenue |

| Automotive | 37% |

| Industrial | 20% |

About 20% of Texas Instruments’ revenue comes from China. It’s a high figure.

Economic Competitives

Extremely diversified business

The chips produced by Texas Instruments are widely used, ranging from washing machines to satellites. It was also the second largest chip supplier for mobile phones; it is the most diversified company in the semiconductor industry and can be said to be the most representative semiconductor company in the United States. You heard right, in the semiconductor industry, Texas Instruments is more influential and representative than Intel.

Texas Instruments has the largest customer list in the semiconductor industry, making the company’s forecast a bellwether for semiconductor industry demand.

Products focused on non-end consumers

Texas Instruments is the largest manufacturer of analog and embedded processing chip used in products required by various commercial users including factory equipment, industrial, automotive, and space hardware. Therefore, Texas Instruments has little visibility in the eyes of general end consumers.

This feature has two major effects:

First of all, the semiconductor industry will always experience big price fluctuations after business cycles and excess product, but because its chips have a long life and lasting value, as compared to peers. This is very different from digital semiconductor chip companies such as microprocessors (most of the better-known chip companies fall into this category), where TI’s products take years to become obsolete, which means that when demand for chips is weak, The accumulated inventory is not as dangerous as other chip makers.

TI’s products generally have lower production process requirements than Intel processors or other semiconductor players. This intense focus on these types of chips has made Texas Instruments one of the most profitable companies in the semiconductor industry, giving it a longstanding ability to spend its cash on dividends and share buybacks.

Amazing net profit margin

Note that Texas Instruments’ net profit margin is as high as 42.35%! It is higher than TSMC (ticker: TSM), and it is higher than software giant Microsoft (ticker: MSFT). I have listed this on page 141 of 2-4 in my book “The Rules of Super Growth Stocks Investing”.

Design and manufacture chip in-house

More than 80% of Texas Instruments’ chip products are produced in its own fabs, and it has not followed the industry and switched to outside OEMs for a long time. Not only that, it produces its own chips, and it is very profitable. It has always been the semiconductor company with the highest profit margin in the world, and even TSMC is not comparable to it. Please note that Texas Instruments is a semiconductor foundry with many chip products. It’s really not easy.

Texas Instruments is the most typical semiconductor manufacturing company. It is not a network company, let alone a software company. Not only does Texas Instruments design its own semiconductors, it is one of the few companies that still manufactures its own semiconductors today. See my other article, “6 Common Semiconductor Investment Myths.” The point is that it can achieve a higher net profit margin than TSMC, which shows how good this company is. Why do I say that? The counter-example is Intel (NYSE: INTC), just think about Intel current status, you should understand.

Texas Instruments’ Moats

Until now, it is still an excellent semiconductor leader in analog, digital signal processing (DSP), and embedded system field; the corporate moat is clear.

Especially in the automotive industry, or the industrial field, they are long-term major customers of Texas Instruments. This is mainly due to the high conversion costs of non-digital chips such as analog, digital signal processing, and embedded systems. That is, a higher moat. The reason is that the cost of conversion is too high, and it is almost impossible to change to a competitor’s product.

According to the McClean report of IC Insights, Texas Instruments ranks number one among the top ten analog fabs in the world, far ahead of its peers, with a market share of 18%, almost twice that of the second-ranked Analog Devices.

Main competitors

Analog chips

Its main competitors in the field of analog chips are Analog Devices (ticker: ADI) and Maxim (ticker: MXIM, which was acquired by Analog Devices in 2020).

Auto semiconductors

According to SC-IQ, in terms of automotive semiconductors, Infineon (ticker: IFNNY) will rank first in the entire automotive semiconductor market in 2021, accounting for 8.3% of the market, with sales of approximately US$5.725 billion. Ranked second is NXP (ticker: NXPI), with a market share of 8% and sales of 5.493 billion US dollars. Renesas Electronics (ticker: RNECY) ranked third, with sales of 4.21 billion US dollars, accounting for 6.1% of the market. Texas Instruments ranked fourth, accounting for 5.6% of the market, with sales of US$3.852 billion, accounting for 21% of the company’s total sales. STMicroelectronics (ticker: STM) is fifth, with sales of 3.65 billion US dollars, accounting for 5.3% of the market.

Texas Instruments’ long-term capital returns

Stock performance

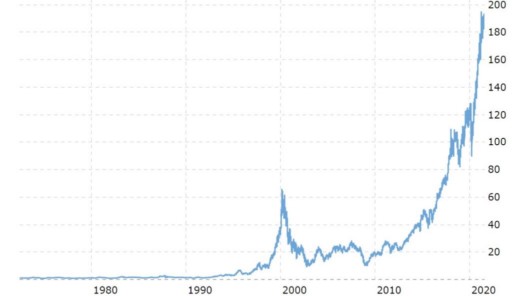

Even if you can’t be like Philip Fisher bought it decades ago (because you may not have been born), that’s okay. If you only bought it ten years ago, the return rate is still as high as 457.10%. Please see my previous post “Great companies are rare, two or three will make you very rich“.

Texas Instruments is also:

- A US-listed company with a market capitalization higher than 98.68% of listing companies.

- Has been listed for longer than 92.76% of listing companies.

- A typical representative of successful US stock companies.

The picture below is the stock price trend chart of Texas Instruments displayed by macrotrends.net so far. Don’t forget that it has gone through 8 stock splits.

Stock splits and dividends

Since Texas Instruments went public in 1953:

- It has undergone 8 stock splits (6 splits of 1 share for 2 shares, 1 split of 3 shares for 1 share, and 1 split of 4 shares for 5 stocks).

- The current dividend yield of Texas Instruments is as high as 2.11% (2.11% is now considered a very high dividend yield in US stocks).

- As far as I know, it is the only technology stock pays dividends for more than 50 consecutive years.

Related books

- “The Chip: How Two Americans Invented the Microchip and Launched a Revolution” by T. R. Reid

- “Texas Instruments 《德州儀器》”, by 溫英超 (Wen Yingchao)

Related articles

- “TSMC negative corp culture and management style are detrimental to its future and growth“

- “Four chip companies account for one-third of S&P 500 gains so far this year

- “Top five lucrative artificial lucrative intelligence listed companies“

- “What’s TSMC DCF intrinsic value?How to calculate it quickly with a free tool?“

- “How many fabs and houses does TSMC have currently and in the future?“

- “Comparison of TSMC, Samsung, Intel’s Yield and Advanced Process“

- “The TSMC cost, sell price, and R&D cost of chip foundry“

- “ASML, who dominate TSMC’s fate“

- “Comparison of TSMC, Intel, and Samsung’s new process roadmaps for future chips“

- “Two long-term threats to TSMC: US and SMIC“

- “Why is TSMC’s profit margin much greater than competitors?“

- “How does TSMC make money?“

- “Zyvex and sub-nanometer semiconductor processes, will Zyvex threat TSMC?“

- “TSMC gets emerging and serious challenges“

- “How does nVidia make money, Nvidia is changing the gaming rules“

- “The reasons for Nvidia’s monopoly and the challenges it faces“

- “Why nVidia failed to acquire ARM?“

- “Revisiting Nvidia: The Absolute Leader in Artificial Intelligence, Data Center, and Graphics“

- “How does Intel make money? and the benefits to invest in it“

- “Intel’s current difficult dilemma“

- “How does Texas Instruments make money? Amazing long term capital reward and company net profit margin!“

- “How AMD makes money? A rare case of turning defeat into victory“

- “Why is AMD’s performance so jaw-dropping?“

- “Qualcomm diversifies success, no nonger highly dependend on phone“

- “How does the ubiquitous Arm make money?“

- “Significant changes in Broadcom’s business approach“

- “Data center, a rapidly growing semiconductor field“

- “How does Applied Materials, lord of semiconductor equipment, make money?“

- “The lucrative semiconductor supply chain“

- “Global semiconductor chip market in detail, big dominators and markets“

- “6 common wrong semiconductor investment myths“

- “Gen 3 semiconductor“

- “Three EDA oligopoly vendors: Synopsys, Cadence, and Mentor Graphics“

- “How does, the EDA oligopoly, Cadence make money?“

- “How does Synopsis, the EDA oligopoly, make money?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.