The simpler the investment, the better, Buffett’s most philosophical quote, In my previous introduction to subsections 1-1 at the beginning of Chapter 1 of my book “The Rules of Super Growth Stocks Investing”, I used a famous quote from Buffett’s influential philosophy in the field of investing,

Category: Investing Concept

Why emerging market stock with high economic growth is not as rewarding as developed countries?

In 2001, Goldman Sachs (ticker: GS) , in order to promote investment in emerging markets with high economic growth, Jim O’Neill has selected four large emerging countries, Brazil, Russia, India, and China

Investors need to think different

As long as a paid worker should agree that there are many undocumentted rules in the workplace, such as can’t think differently.

People believe successful investors are survivorship bias cannot succeed

Noticed that many people, regardless of Wall Street and many friends around me, attribute Buffett’s investment success to the Survivorship Bias. This view includes two things

Why do most people fail in stocks investment? 4 simple reasons

There are hundreds of reasons for why people fail in stocks investment, and there is never any lack of discussion.

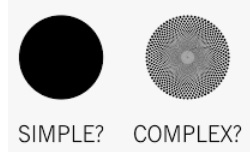

The main investment principles of successful investors are similar

The main investment principles of successful investors are similar. Buffett once lamented that “There seems to be some perverse human characteristic that likes to make easy things difficult.” I personally think that this is also the biggest investment defect committed by most investors (especially younger investors). I wrote at the beginning of 1-1 in my book

I would rather be vaguely right than precisely wrong

I would rather be vaguely right than precisely wrong. Warren Buffett saying quoted in The Warren Buffett Way by Robert G. Hagstrom, Wiley, November 4, 1994. Buffett admits, for the simple reason that calculating future capital expenditures often requires rough estimates “I would rather be vaguely right than precisely wrong.”

The valuation influence of stock liquidity and stock split on listed companies

The valuation influence of stock liquidity and stock split on listed companies. For a long time, Warren Buffett’s Berkshire company stock has been poorly rated (I didn’t write it wrong, no one should be surprised). One of the main reasons is the poor liquidity in the market, that is, very few people trade the stock.

Mistakes of omission and mistakes of commission

Buffett explained “I’ve made all kinds of bad decisions that have cost us billions of dollars. They’ve been mistakes of omission and mistakes of commission.

Investing has no formulas, but there are ways to invest successfully

There are ways to invest successfully, but there can be no formulas. This post will repeatedly quote the words in my book “The Rules of Super Growth Stocks Investing”, and the words in the book referred to are my book.