Successful businesses are improvers, not inventors. Many investors are working hard to find companies that can disrupt the market or fundamentally change technology, hoping to seize the opportunity and gain the first opportunity to invest,

Category: Investing Concept

Questions must be clearly answered before entering the stock market

clearly answered

Do it right a few times in your lifetime is enough

Do it right a few times in your lifetime is enough, Good investments are very rare, I quoted Charlie Munger, “Good investments are very ‘rare’, and when this once-in-a-lifetime investment opportunity presents itself, you have to bet all your chips.” in my book “The Rules of Super Growth Stocks Investing”

Investing is not voting

Investing is not voting, mentioned the phrase “investing is not voting” in three places in my book “The Rules of Super Growth Stocks Investing”: 1-5, 5-4, and postscript.

Richer, Wiser, Happier

Richer, Wiser, Happier. You may have read a lot of reviews of this book “Richer, Wiser, Happier”, but I’m going to talk about this book in a different way and from a different perspective.

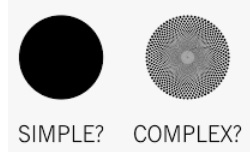

The simpler the investment, the better

The simpler the investment, the better, Buffett’s most philosophical quote, In my previous introduction to subsections 1-1 at the beginning of Chapter 1 of my book “The Rules of Super Growth Stocks Investing”, I used a famous quote from Buffett’s influential philosophy in the field of investing,

Why emerging market stock with high economic growth is not as rewarding as developed countries?

In 2001, Goldman Sachs (ticker: GS) , in order to promote investment in emerging markets with high economic growth, Jim O’Neill has selected four large emerging countries, Brazil, Russia, India, and China

Investors need to think different

As long as a paid worker should agree that there are many undocumentted rules in the workplace, such as can’t think differently.

People believe successful investors are survivorship bias cannot succeed

When I wrote about Buffett a few days ago, I noticed that many people, regardless of Wall Street and many friends around me, attribute Buffett’s investment success to the Survivorship Bias

Why do most people fail in stocks investment? 4 simple reasons

There are hundreds of reasons for why people fail in stocks investment, and there is never any lack of discussion.