Sino-US confrontation will not hurt U.S. stocks too much.

Category: Long Term Investing

79% of Buffett’s portfolio is invested in just 6 stocks

A whopping 79% of Buffett’s portfolio $338 billion is invested in just six stocks.

Inflation-proof investments

Selecting companies that can stand out under inflation is an indispensable factor in Buffett’s investment technique

Sloth is a great virtue in stock investment

Buffet’s view in shareholder letters Buffett is a big advocate of inaction. In his 1996 letter, he explains why: almost every investor in the markets is better served by buying a few reliable stocks and holding on to them long-term rather than trying to time their buying and selling with market cycles. “The art of investing in … Continue reading “Sloth is a great virtue in stock investment”

Buffett’s most basic mentality of investing in stocks

Buffett’s basic mentality for stock investment, the most classic basic description, and many content fragments have been repeatedly quoted by the outside world.

How Buffett Structures His Long-Term Investment Portfolio

In his 1996 shareholder letter, Buffett explained in great detail how he structured his long-term investment portfolio. Many of the contents of this letter have been quoted repeatedly so far, and it can be regarded as a very important shareholder letter.

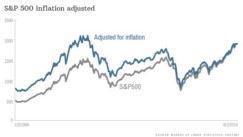

Why do stock prices automatically rise with inflation?

The origin of this article A friend wrote to me, the original text is: “I read your blog article and mentioned that “stock prices will automatically rise with inflation”. After thinking about it for a long time, I still don’t understand it. Could you please give me a practical example to help me out? Let … Continue reading “Why do stock prices automatically rise with inflation?”

The companies Buffett owns more than 20%

Why the companies Buffett owns more than 20% matters?

Two or three stocks in your life can make you very rich

I have repeatedly emphasized in the 4-3 of my book “The Rules of 10 Baggers” and 1-5 in the “The Rules of Super Growth Stocks Investing“, as well as in the blog: “An investor only needs to choose two or three stocks in his life. Can make you very rich; without holding too many stocks, … Continue reading “Two or three stocks in your life can make you very rich”

Dear Shareholder

After reading Dear Shareholder, I was reminded of “Outsiders” which I introduced on this blog.