Are you “not allow” or “unwilling” to spend time researching stocks?

Category: Fundamental Analysis

What is business key operation figure? Take major industries as examples

What is business operation figure? Take major industries as examples, The most effort-saving and simplest way

Is Microsoft’s personal computer computing department a tasteless one?

Microsoft’s personal computer computing department includes Windows, Surface devices, Xbox, games, search engine Bing.

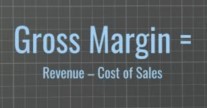

Gross margin is a great indicator to judge the management

The simplest indicator to judge the execution of the management: Gross Margin

ROE, the most important management indicator

The Return On Equity (ROE) algorithm is “net profit after tax/shareholder equity × 100%”, which is one of the few financial figures that can be used to measure the operational performance of a company’s leadership team. It represents the efficiency of the company’s profit for shareholders, and it can also be said to measure the company’s overall capital utilization efficiency. Therefore, the higher the value, the better.

Are analyst reports useful?

Are analyst reports useless?

Why people with high IQ prone invest failed?

Why people with high IQ prone invest failed. In stock investment, temperament is the final decisive factor, not intelligence and IQ, nor the amount of funds. I certainly know that most people may disagree with my statement, but I’m just telling the truth that people don’t want to admit, let alone say.

The significant valuation impact of diversity to listed companies

The valuation impact of diversity to listed companies. I have always emphasized in the book “The Rules of Super Growth Stocks Investingrowth Stock Investment Rules” that investors do not like all kinds of uncertainties.

Figure out essential things before buy a stock to make sure invest success

At least figure out those things before investing in a business?