Tencent vs. Alibaba, What do western investors think of these two companies, These two stocks are of indescribable importance in terms of index (representing China’s economy and technology) or substantive (real shareholding purchase).

Apple’s small privacy change caused US stocks evaporate 200 billion U.S. dollars in one day

Apple’s small privacy change caused US stocks evaporate 200 billion U.S. dollars in one day

Thinking cannot be outsourced

Thinking cannot be outsourced. Investment is a marathon of life, and we must persist to the end. In section 1-1, of my book “The Rules of Super Growth Stocks Investing”, I pointed out 8 key points of a simple roadmap for stock investment for investors

Schedule booking reminder to “The Rules of Super Growth Stocks Investing” book launch event and speech, Taipei (10/25/2021)

Schedule booking reminder to “The Rules of Super Growth Stocks Investing” book launch event and speech, Taipei (10/25/2021)

TikTok, the rival of all social networks

Let’s talk about TikTok, In September, TikTok quietly announced the milestone of reaching billions of monthly active users (aka MAU).

Venture capital and unicorns introduction

Introduction to venture capital and unicorns, Although this term has actually existed for about 20 years, as far as I can remember, most people in the investment world did not pay attention to the term unicorn at least before the financial turmoil in 2008.

No fear of miss out a great company, No FOMO

No fear of miss out a good company, FOMO

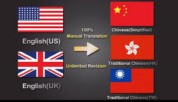

Multilingual website launched – Simplified and Traditional Chinese plus English

Multilingual website launched – Simplified and Traditional Chinese plus English

Booming India stock market and the emerging Indian tech giants

India stock market and the emerging Indian tech giants

Haters, the cancer of modern society

Don’t become the cancer of modern society – trolls and haters, I have never concealed my aversion to trolls and haters. They have a negative influence on our society, even to the extent of poisoning.