The importance of the App Store legal battle between Apple and Epic Games, Alphabet and Apple forced to lower commissions to 15%

Author: Andy Lin

The disadvantages of retail investors

disadvantages of retail investors, In the previous blog article “The advantages of retail investors”, after receiving a lot of feedback from readers, this article is going to fulfill my previous promise–compared with institutional investors,

The bright future of the electric vehicle industry

The future of the electric vehicle industry

Antitrust and governance faced by Chinese and American technology giants

Antitrust and governance faced by Chinese and American technology giants, My blog article “How should investors view companies being included in the antitrust investigation list” published a few days ago caused a lot of feedback from readers.

How Microsoft makes money? What’s the next?

How Microsoft makes money? Where is the future?

Zero to One

Zero to One

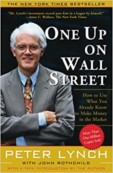

“One Up on Wall Street”, Peter Lynch’s great book for investing newbie

One Up on Wall Street. This is a book I often recommend “Primer books for investing in the Stock Market”, and the self-preface of the book is well written. The reasons to recommend Peter Lynch’s book “One Up on Wall Street” are as follows:

Has the moat of ubiquitous Visa and Mastercard credit card networks loosened?

Has the moat of the two major credit card networks loosened?

Why do many Chinese companies want to be US listed?

Why do many Chinese companies want to be US listed? According to statistics at the end of October 2020, there are 26 Chinese companies going to the U.S. for IPOs in 2020. Everyone must be very suspicious that China has its own three stock exchanges in Shanghai, Shenzhen, and Hong Kong.

Pension Funds

Pension Funds, The scale of pension funds in countries around the world is much larger than that of sovereign funds. In 2018, the total assets of global pension funds were US$40 trillion, and the average growth rate in the past 10 years was 5.3%.