I recently took a general look at Buffett portfolio , and I made some big discoveries. Buffett basically only invests in companies with fixed cash flow income. He likes companies that actively implement stock repurchases. Almost every shareholding has dividends. He likes cheap companies.

Author: Andy Lin

An excellent book for career and life- The Almanack of Naval Ravikant

Almanack of Naval Ravikant is a book about the venture capital AngelList CEO Naval Ravikant’s own writings on wealth, philosophy, and investing.

How AMD makes money? A rare case of turning defeat into victory

The stock price has risen from the lowest point of US$ 1.66 on September 28, 2015 (close to the threshold of delisting), and it has risen to US$ 137.5 at an alarming rate in only 6 years, which is an almost impossible task. Shares rose 148% in 2019, making it the biggest gainer for the year in the S&P 500 and Philadelphia Semiconductor Index, surging 21-fold in ten years. I mentioned AMD in my book of “The Rules of Super Growth Stocks Investing”

The main investment principles of successful investors are similar

The main investment principles of successful investors are similar. Buffett once lamented that “There seems to be some perverse human characteristic that likes to make easy things difficult.” I personally think that this is also the biggest investment defect committed by most investors (especially younger investors). I wrote at the beginning of 1-1 in my book

I would rather be vaguely right than precisely wrong

I would rather be vaguely right than precisely wrong. Warren Buffett saying quoted in The Warren Buffett Way by Robert G. Hagstrom, Wiley, November 4, 1994. Buffett admits, for the simple reason that calculating future capital expenditures often requires rough estimates “I would rather be vaguely right than precisely wrong.”

How does Nike make money? The role model of growth stocks in non-tech industry

Nike, a role model of growth stocks in non-tech industry. Since I have described in detail how to screen for super growth stocks in the book “The Rules of Super Growth Stocks Investing”, Chapter 5 of the book also mentioned that I own Nike (ticker: NKE) stock before, although I focus tech stocks on the book.

Successful investors must persist to the end

Investors must persist to the end. Most of the investors who can make a lot of money, and finally succeed, none of them rely on luck. Investors who rely on luck cannot be successful investors who make big money.

Join Freely Facebook group for US stocks long-term investment

Free Facebook and Twitter for US stocks long-term investment

Why Buffett deserves further study

Why Buffett deserves further study. Buffett is a must study. For those who have read my books “The Rules of Super Growth Stocks Investing” and blogs should find that investors who want to succeed should find a successful investment master whom they admire, and find out all the possible reasons for his success. After finding it, studied it carefully and thoroughly.

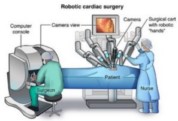

How does dominated Intuitive Surgical make money?

There should be no one who does not know about the Da Vinci medical surgical robot, right? Da Vinci Medical Surgical Robot is now more famous than this company Intuitive Surgical. I mentioned this company in the preface of my book “The Rules of Super Growth Stocks Investing”.