Compay profile Introduction to a16z Andreessen Horowitz (aka a16z) is a well-known venture capital company in Silicon Valley founded by the two famous entrepreneurs Marc Andreessen and Ben Horowitz. Founders For Mark Anderson, you can see the introduction to my previous post of Two famous essays by Marc Anderson on software and artificial intelligence And … Continue reading “a16z, Silicon Valley’s most aggresive venture capital firm”

Tag: CRM

The value of Palantir, pros and cons of Palantir investment

Palantir’s reliable revenue, it has long relied on bids from the U.S. government and a handful of Western allies that are very close to the United States. Palantir’s top management certainly knew the urgency of this issue, so they began to use their own advantages to establish relationships with business partners, hoping to change the single nature of the company’s business and expand the company’s products to customers outside the government, or to Application scenarios other than military and national security.

AI Agent will be the next wave of software industry

AI Agent is a program that can perform long-term tasks with little need for human supervision during the execution of the task

The reasons behind Broadcom share price consistantly outperformance

“99% of all internet traffic crosses through some type of Broadcom technology”, Broadcom said. The reason behind the long-term continued outperformance of Broadcom share price is that I vote for Broadcom CEO Hock E. Tan.

How ServiceNow, corp worflow, best share performing in past decade, makes money?

ServiceNow, with such performance, among the large listed software companies in the US stock market, the performance of the stocks I track should rank among the top.

How does database monopoly Oracle make money? What are the prospects?

Missing out on cloud computing has created a serious disconnect between the former second-largest software company and the mainstream software market, which has also affected Oracle’s stock price performance in the past two decades.

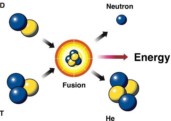

The current progress of nuclear fusion, and relevant companies

The goal of a nuclear fusion is just a few years away. The profit may reach a thousand times. As an investor, this may be a “lose your money, or earn 1000 times” investment opportunity.

Vertical software is expensive, but worth the investment

Vertical software, The official name of industry software should be vertical market software, which is software developed for a niche industry or for the needs of a unique customer group.

Why is it difficult for investors to discover Shopify potential early?

This article will discuss what readers want to know most: as an investor, how can you discover high-growth companies like Shopify early on? Shopify is not just a website-building software, nor is it an e-commerce marketplace like Amazon.

The pros and cons of CEO returning, Boomerang CEO

Between 1992 and 2017, 167 CEO return in the S&P Composite 1500 returned to their posts.