Buffett admits he has no ability to forecast, manipulated numbers must not be honored, if forecasts cannot meet, and the result is only fake.

Category: Economics

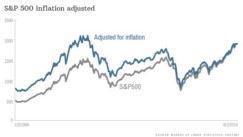

Why do stock prices automatically rise with inflation?

When inflation, prices raised, the revenue will increase according to the ratio of the price increase, and of course the net profit will also increase. The increase in revenue and net profit will naturally push up the stock price; because the valuation of the stock Will automatically increase with the increase in revenue and profit

How do monopolies or oligopolies work in the real world?

In the real world, there will be no perfect competition, but monopolies or oligopolies enterprises

How is banking investment different from other industries?

No one would expect bank stocks to rise sharply. Most of the time, the performance of bank stocks will underperform the market. The reason is simple. There are only two kinds of people who will buy bank stocks.

Stock split is a long-term stock bullish signal with brilliant outlook

Stock split is a long-term stock bullish signal with brilent outlook, My previous articles in 5-5 of the book “The Rules of Super Growth Stocks Investing” and my blog post of “Why stock split? the strong reasons and impacts” and “The valuation influence of stock liquidity and stock split on listed companies”,

Amid global recession, investor’s hard days still ahead

The United States is deeply afraid of repeating the mistakes of the super recession in the 1980s, forcing the Federal Reserve to raise interest rates six times so far this year to curb it. It has risen from 0.25% to 4.00%.

Stock Better than the S&P 500, Procter & Gamble (P&G)

Stocks Better than the S&P 500, Procter & Gamble (P&G) What I want to introduce today is a well-known company Procter & Gamble (ticker: PG) that I mentioned in the last section 5-6 of my book “The Rules of Super Growth Stocks Investing”.

The impact of the Inflation Reduction Act on US stocks

In order to reduce the impact of inflation on the US economy, raise more taxes to fight inflation. U.S. President Joe Biden sign a $430 billion “Inflation Reduction

Act” on August 16, 2022.

Should investors care about currency exchange risk when investing in US stocks?

Even if the number 28% is “exchange loss” (you can take it as the risk of investment), compared with the return of 20.82 times, the difference between the two returns is 74.36 times! Which one is persuasive? Therefore, discussing currency exchange risk is a waste of time and meaningless, unless investors focus on short-term foreign exchange speculation.

Commercial-oriented firms perform better in recessions

U.S. stocks have rebounded a lot from the bottom of the bear market in June. Many investors believe that the worst time has passed; but the reality is not so optimistic. But there is another important point in this article — commercial-oriented companies are more resilient to recessions.