"The Thinking Machine" is about the founding history of Nvidia, Jensen Huang personal biography, and how Nvidia evolved and grew into the world’s most important chip manufacturer. The author actually interviewed hundreds of people who were directly related to the founding of Nvidia or Huang Renxun at the time, and all of them are first-hand interview records. If you are an investor in Nvidia stocks, it is recommended that you take the time to read this book.

Category: Stock Valuation

Why is Costco’s valuation so staggering?

Don’t use ordinary retail or general industries to explain its valuation. Costco’s valuation phenomenon in the retail industry should be comparable only to Amazon.

Primer’s book to know Buffett-“Warren Buffett: Investor and Entrepreneur”

“Warren Buffett: Investor and Entrepreneur” is published in 2022, written by Todd. A book about Buffett by Todd A. Finkle.

Why is TSMC valuation much lower than US peers?

When large-scale investment institutions in the United States consider the TSMC valuation, they use the perspective and starting point of the United States to compare TSMC with its local semiconductor peers in the United States

Supermicro, a repeat offender of scandals, valuation is not justified and unsustanable, no worth for long-term holding

Supermicro has absolutely no autonomy in its business, no moat, ultra-low profit margins, and has been involved in negative scandals “repeatedly”. Competitors are too powerful—it is not recommended to hold it.

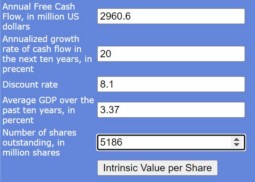

What’s TSMC DCF intrinsic value?How to calculate it quickly with a free tool?

use the discounted cash flow method to estimate, What’s TSMC DCF intrinsic value?

How does the ubiquitous Arm make money?

Without Apple, there would be no Arm

Why Eli Lilly become global pharmaceutical market value king?

It is recommended that you also read my previous post related to Eli Lilly (ticker: LLY): Two future star drugs in hand Because it holds two future star drugs, Eli Lilly is very likely to become the world’s first listed pharmaceutical company with a market value of more than one trillion US dollars! With Alzheimer’s … Continue reading “Why Eli Lilly become global pharmaceutical market value king?”

PayPal’s current crisis and appeal

PayPal in my two books In my book “The Rules of Super Growth Stocks Investing“: In the book “The Rules of 10 Baggers“: How bad is it? The pandemic catalyst is no longer In the two or three years before 2021, PayPal’s stock price, like most technology stocks, has repeatedly hit new highs. Since the … Continue reading “PayPal’s current crisis and appeal”

When to Sell Stocks?

When to Sell Stocks Won’t Be Easier Than Buying