Sino-US confrontation will not hurt U.S. stocks too much.

Category: Long Term Investing

79% of Buffett’s portfolio is invested in just 6 stocks

A whopping 79% of Buffett’s portfolio $338 billion is invested in just six stocks.

Inflation-proof investments

Selecting companies that can stand out under inflation is an indispensable factor in Buffett’s investment technique

Sloth is a great virtue in stock investment

A certain type of sloth is necessary. The biggest enemy of retail investors is over-trading.

Buffett’s most basic mentality of investing in stocks

Buffett’s basic mentality for stock investment, the most classic basic description, and many content fragments have been repeatedly quoted by the outside world.

How Buffett Structures His Long-Term Investment Portfolio

In his 1996 shareholder letter, Buffett explained in great detail how he structured his long-term investment portfolio. Many of the contents of this letter have been quoted repeatedly so far, and it can be regarded as a very important shareholder letter.

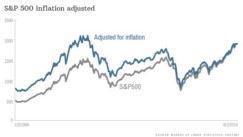

Why do stock prices automatically rise with inflation?

When inflation, prices raised, the revenue will increase according to the ratio of the price increase, and of course the net profit will also increase. The increase in revenue and net profit will naturally push up the stock price; because the valuation of the stock Will automatically increase with the increase in revenue and profit

The companies Buffett owns more than 20%

There are no technology stocks in the list of companies in which Buffett holds more than 20% of his shares. Why? What is the commonality? The significance of holding more than 20% of shares, several cases of Buffett holding large shares

Two or three stocks in your life can make you very rich

Two or three stocks in your lifetime can make you very rich. Excellent companies will still be excellent companies three to five years later. However, most people do not agree with this statement. They always think that the stock prices of excellent companies are always high, and this perception is not wrong. But investors always miss the forest for the trees, mistaking price for value and misplacing cause and effect.

Dear Shareholder

After reading Dear Shareholder, I was reminded of “Outsiders” which I introduced on this blog.