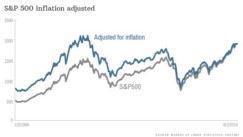

When inflation, prices raised, the revenue will increase according to the ratio of the price increase, and of course the net profit will also increase. The increase in revenue and net profit will naturally push up the stock price; because the valuation of the stock Will automatically increase with the increase in revenue and profit

Category: Investing Methods

The companies Buffett owns more than 20%

There are no technology stocks in the list of companies in which Buffett holds more than 20% of his shares. Why? What is the commonality? The significance of holding more than 20% of shares, several cases of Buffett holding large shares

How is banking investment different from other industries?

No one would expect bank stocks to rise sharply. Most of the time, the performance of bank stocks will underperform the market. The reason is simple. There are only two kinds of people who will buy bank stocks.

Two or three stocks in your life can make you very rich

Two or three stocks in your lifetime can make you very rich. Excellent companies will still be excellent companies three to five years later. However, most people do not agree with this statement. They always think that the stock prices of excellent companies are always high, and this perception is not wrong. But investors always miss the forest for the trees, mistaking price for value and misplacing cause and effect.

The career annualized return on investment of top investment masters: Buffett, Simons, Lynch, Dalio, Keynes, Munger, Soros, Miller, Karaman, Graham

The career annualized return on investment of top investment masters: Buffett, Simons, Lynch, Dalio, Keynes, Munger, Soros, Miller, Karaman The criteria for the investment masters selected in this article mainly include the following.

Growth vs. Value Investing, Buffett’s view

It’s an argument between growth vs. value investing: value is the discounted value of the investment’s future present cash flows, while growth is only a prediction process used to determine value.

Dear Shareholder

After reading Dear Shareholder, I was reminded of “Outsiders” which I introduced on this blog.

The Psychology of Money

The Psychology of Money, Why recommend this book? “The Psychology of Money” is a book about money and wealth by Morgan Housel. This book is about some classic financial and investing ideas, such as Nassim Taleb, Daniel Kahneman and Warren Buffett.

The investment strategy of the Nobel Foundation

In 1900, Nobel Foundation’s capital was SEK 31M, in 2021, assets reached SEK 6.103B. In 121 years, asset increased 200 times. In 1953, DJI was 280 when it first bought, in 2021, it was 35,294, a 126-fold increase in 68 years.

How does Texas Instruments make money? Amazing long term capital reward and company net profit margin!

Take Texas Instruments (aka TI, ticker: TXN) as an example; this company was founded earlier than Intel (ticker: INTC), for Intel, I suggest you refer to my previous blog post “How Does Intel Make Money? And the Benefits of Investing in It”