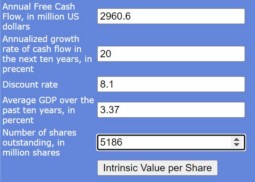

use the discounted cash flow method to estimate, What’s TSMC DCF intrinsic value?

Category: Financial statements

How does the all-powerful Huawei make money?

No company in modern corporate history has ever won this honor. You can imagine the importance of this enterprise. The United States has discovered the signs of Huawei’s development. For the first time in history, the Department of Defense replaced the Department of Commerce to supervise Huawei.

Fintech’s valuation plummeted and current dilemma

Fintech is no longer a super new blue ocean in the technology and financial circles ten years ago.

PayPal’s current crisis and appeal

PayPal in my two books In my book “The Rules of Super Growth Stocks Investing“: In the book “The Rules of 10 Baggers“: How bad is it? The pandemic catalyst is no longer In the two or three years before 2021, PayPal’s stock price, like most technology stocks, has repeatedly hit new highs. Since the … Continue reading “PayPal’s current crisis and appeal”

How does Intuit, the leader in financial management software for individuals and small businesses, make money?

Company history Intuit (ticker: INTU) was founded in Palo Alto, California in 1983 by Scott Cook and Tom Proulx. The first product they developed was Quicken, and later Microsoft launched Microsoft Money competed with Quicken, but with little success. After going public in 1993, Microsoft once tried to buy the company, but the transaction fell … Continue reading “How does Intuit, the leader in financial management software for individuals and small businesses, make money?”

Three questions that financial statements must answer

Financial statements need to provide answers for three questions.

SEC asked: important risks disclosed in financial report

Buffett carefully explained the important risks that the SEC must disclose in the financial report.

US credit rating downgrade by Fitch, the easons and implications

Fitch announced on August 2, 2023 that it would downgrade the US credit rating by one notch from the top AAA to AA+

Insights on company governance

In Buffett’s 2002 shareholder letter, he put forward his views on the company governance. The following is a list of objects, elements, members, and components that must be included in corporate governance for a typical listed company.

Why would Buffett oppose to EBITDA and financial forecasts?

In Buffett’s 2020 shareholder letter, he mentioned several common but unreasonable accounting techniques used by CEOs of US-listed companies in their financial statements: especially EBITDA and financial forecasts.